As investors, we participate in the long-term growth of the global economy. This will naturally have ups and downs, but in the long run populations grow, technology advances, industries become more productive, emerging economies become developed, and the poor become middle class. The global economy will always recover, to reach new levels in the future.

Investors and business managers don’t like uncertainty because it makes planning difficult. Whether it’s Hilary or Donald, or whether it’s Boris or Jeremy - when the result is finally known, investors breathe a sigh of relief because a little bit of uncertainty has been removed.

COVID-19 has created an outbreak of uncertainty. How fast will it spread? How will it effect the global economy? How quickly will things recover? COVID-19 was in fact the perfect trigger for a correction that was probably overdue.

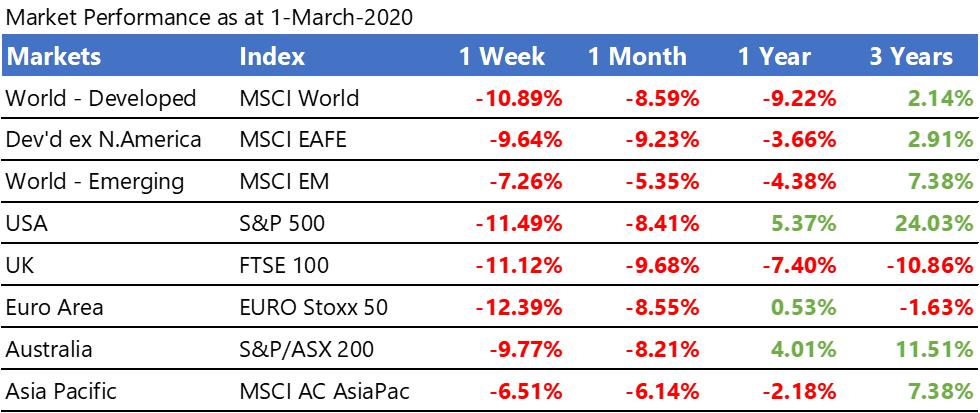

Consequently, the last week has seen the most dramatic falls in stock prices since the global financial crisis in 2008.

So, being the calm and logical investors the we are, how should we react?

ONE. Don’t Make Knee-Jerk ‘Sell’ Decisions

It’s instinct to want to ‘get out’, but this is a common mistake. It is almost impossible to ‘time’ or ‘outguess’ a market, especially when it’s being driven by sentiment. Any snippet of news is a potential trigger for movement in either direction. Emotional selling brings the risk that we exit investments when prices are low, miss a rebound, and have to enter again at higher prices.We should stay calm, recall our initial investment strategy, and not worry about volatility in the equity part of our portfolio. Stay in the market: the S&P500 grew 85% in the three years after the global financial crisis.

TWO. Trust In Your Asset Allocation

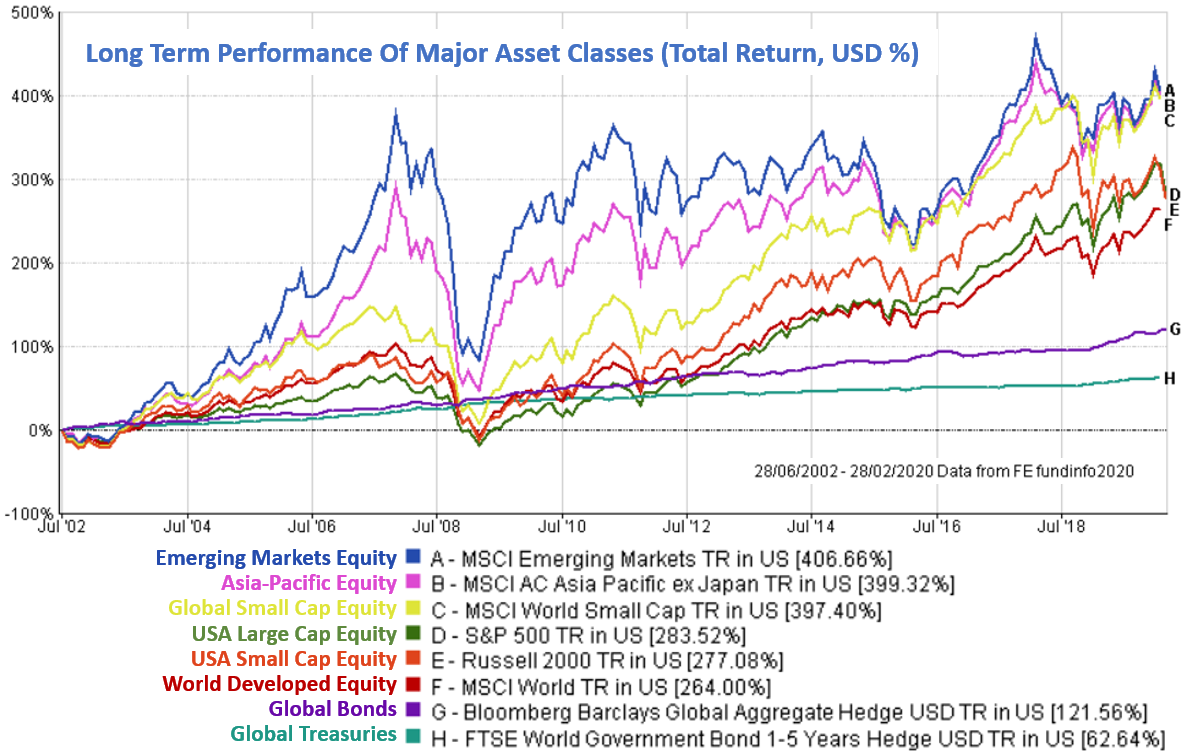

The fundamental part of asset allocation is the split between bonds and equity. And appropriate diversification within each segment. History tells us that time in the market rewards the patient investor, and that the most volatile investments tend to deliver the best long run returns.Guided by your investor risk profile, an appropriate allocation towards quality bonds covers the ‘safe and steady’ part of your portfolio... Letting you stay relaxed about volatility in share prices, and stay invested for the longer-term rewards.

Long Term Performance of Major Asset Classes (Total Return, USD %)

THREE. Younger Savers Should Look To Increase Investment

As Warren Buffett famously said in his hamburger analogy, “Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”If we’re about to move into a spell of poor or negative global growth, and depressed stock prices, start planning now to save a few hundred dollars a month extra.

Regular monthly savings is key to a ‘dollar cost averaging’ strategy, and it works. In a real-world example, regular savings into the FTSE 100, starting at the market top in January 2008, would have created 18% returns by 2011, just three years later – during the period of the worst financial downturn in modern times.

In the Global Financial Crisis, Dollar Cost Averaging Delivered 18% Returns in just Three Years On The FTSE100, Without Having To Time The Market

FOUR. New Investors Should Wait and Be Ready as Opportunities Emerge

If you are not yet invested, or have cash waiting on the side-lines and ready to go, then you are in a wonderful position to capitalise on the mayhem in the global markets. Make some time soon, to have a chat with your financial advisor.If you don’t have a financial advisor, or would like a new one, please contact me.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"