The UAE is a low tax environment, with negligible direct taxation. A major reason expatriates come to work here is zero tax on personal income and capital gains. However, most expats also plan to return home at some point, or move on to another international location.

So, it is important for all such individuals to make smart decisions about their savings and investment structures as early as possible, rather than wait until they leave UAE. The reason for this is the Common Reporting Standard.

Financial Planning Implications of the Worldwide Common Reporting Standard

Starting from 2017, global governments are swapping your financial information with each other, through the regime known as AEOI - Automatic Exchange of Information. This regime was proposed and agreed by the OECD (Organisation for Economic Cooperation and Development) and the G20 (Group of Twenty major economies). The regime is implemented in two parts:- MCAA - a multilateral competent authority agreement - this is the formal agreement that countries sign up to, creating the legal framework by which they exchange information with each other; and,

- CRS - a common reporting standard - this is the technical standard that lays out the information to be exchanged and how it is reported by every financial institution to the relevant authority. The CRS thus affects every bank, asset manager, investment company, and financial institution in every country that has signed up (currently more than 100 countries).

CRS means that it is no longer possible to invest here in UAE (or indeed almost anywhere) and then ‘forget’ to declare income or gains after returning home – governments annually report all investments held back to your resident tax jurisdiction.

Annual reporting through CRS includes your full name, tax ID number, passport number, date of birth, place of birth, account balances at year start and year end, and total fund flows in and out of your accounts. In other words, wherever you are - the tax man knows who you are, and all the details of your financial assets held abroad, so that he can fully tax you.

This means, whilst you are abroad in a low tax location like UAE, in practical terms you have two choices:

- Use a ‘non-wrapped’ account, such as an online brokerage or regular bank account, and plan to close out and take your cash back with you when you leave, or;

- Use an internationally based ‘wrapped’ savings & investment account, to allow your money to grow over the long term legally in a tax-free manner, and potentially get additional tax savings even when you later return to your home country.

The Importance of Gross Roll-Up

For expats and mobile professionals, CRS makes planning for future tax liabilities all the more essential. The ideal way to mitigate or defer certain tax obligations is to use a structure or wrapper that provides ‘gross roll-up’. Gross roll-up is the term applied when your investment grows free of income tax (for example on dividends) or capital gains tax (on realised profits) at source.Compounded year on year, the effect of gross roll-up can be enormous. As a simplistic example, suppose you invest $100,00 for the long term, and investment profits are 8% per annum. Suppose tax is due at 20% on those gains, and the remainder is reinvested annually. In this scenario, over twenty years your initial $100,000 would grow to $345,806.

On the other hand, if you used a tax-efficient wrapper that provides gross roll-up: all profits are reinvested annually with no tax deductions. The end result would be your $100,000 growing to $466,096 in twenty years. That’s a massive 35% increase in the size of your final value, just by using the right investment wrapper.

The value of gross roll-up can be significant, and should not be ignored when you are considering international investments. If you want your money to grow in the long term free of capital gains tax, and are likely to be moving on from UAE sooner or later, then tax-efficient investment wrappers are an important tool.

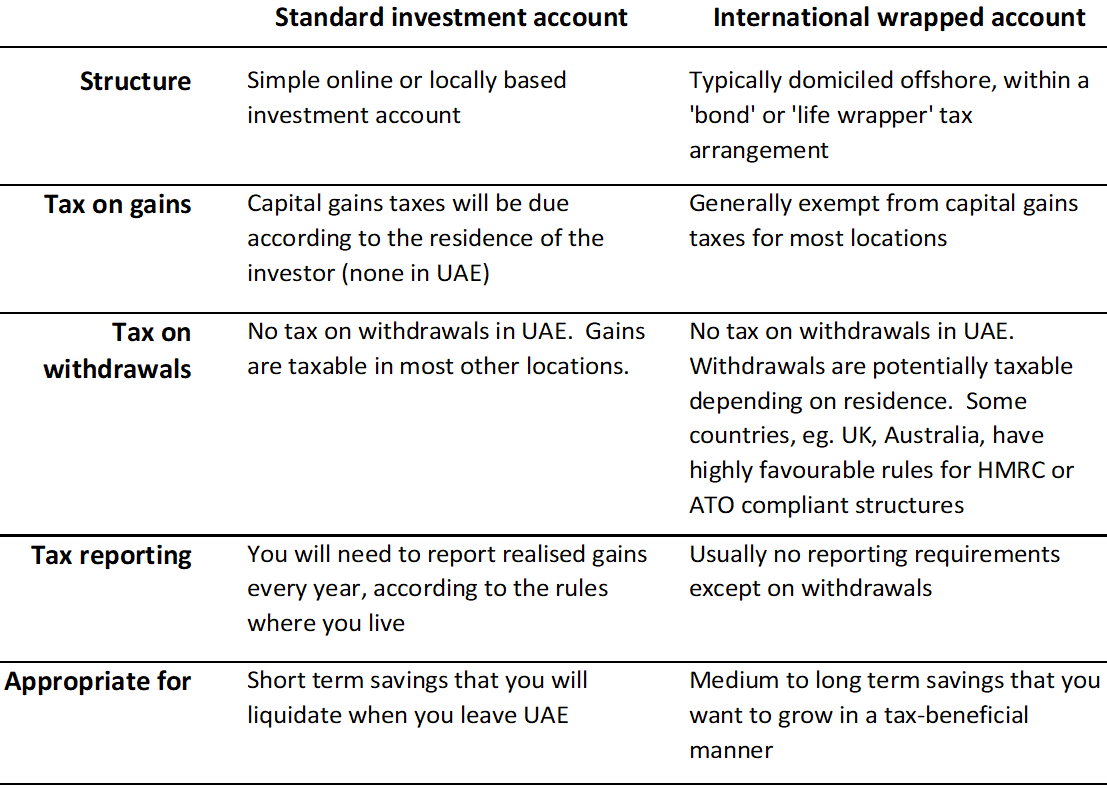

The table below is a quick summary of the differences between a standard investment account and an international wrapped account.

For individuals of every nationality, the first step is to identify the right form of savings & investment structure, to best match your current and likely future circumstances.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"