28/9/2022.Why Advisors Don’t Recommend Selling Out In A Recession

A long time ago, I once heard my father jokingly instruct my mother on reversing the car. “The trick is, to stop just before you hear the bump.” An obvious statement, but with the kind of logical paradox my dad enjoyed: if you stop before the bump, then you never actually hear it – so how do you know when it would have been? And if you do in fact hear it, well, it’s too late anyway, isn’t it?

How to Unblock Your Emotional Brain-Freeze

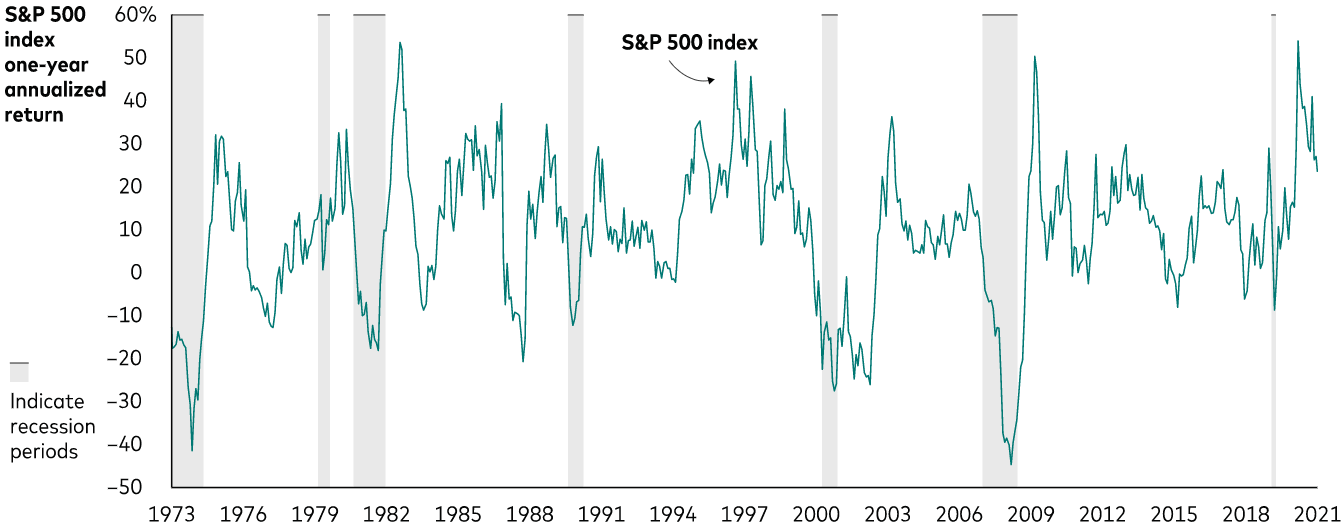

STEP 1. Grab any long-term performance chart of any stock-market index. Here’s the S&P500 (source), below.

S&P 500 Index Historical Performance (Log Scale, Not Inflation-Adjusted)

STEP 2. You’re allowed to invest only once per decade. So, look at the chart and for each decade choose your preferred investment date.

(Drumroll...)

REVELATION 1. I magically predict you’ll have chosen to invest in the troughs, not the peaks.

REVELATION 2. And most of those troughs coincide with recessions (the shaded bars on the chart).

(I also do card tricks, and am available for children’s parties.)

Short-Termism Punishes Investors

When equity markets head south, short-termism can get the better of us, and the instinct to ‘sell out at any cost’ can be overwhelming. This usually turns out to be the wrong thing. Why?

Because this: How do we know when to get back into the market again?

Three Basic Facts About Market Bottoms

Selling an investment with the intention of buying it again later is the definition of market timing, which (and I’m sure you’ve heard this before) even the ‘experts’ can’t do reliably. You’re just as likely to end up in a worse situation. Consider these facts:

- The further prices have fallen from their previous high, the greater the chance that today is the market bottom.

- The only way to know for sure that we’ve reached market bottom, is to see it in the rear-view mirror - prices have started to recover and are already heading back up.

- Historically across equity markets, the strongest recoveries tend to follow close behind the worst declines.

The conjunction of the above means that if we sell out as markets fall, we are almost guaranteed to be late to the party when the rebound comes (as it always does). Why give ourselves more stress we don’t need? Let’s stay invested and go do something else instead.

The Most Successful Investors

This discussion serves to highlight the benefits of staying in the market. There is an industry joke that the most successful investment accounts are the ones whose owners are deceased. Many a true word is spoken in jest.

Trust Your Asset Allocation

Of course, the above assumes that we have a sensible asset allocation in the first place – one that matches our risk profile via the right mix: enough ‘safety’ (fixed income), enough ‘adventurous’ (small cap, emerging markets, specialist themes) and enough ‘middle of the road’ (the core holdings that capture long term growth from developed markets and we almost never sell).

Take Withdrawals from Fixed Income (Bonds), not Equity

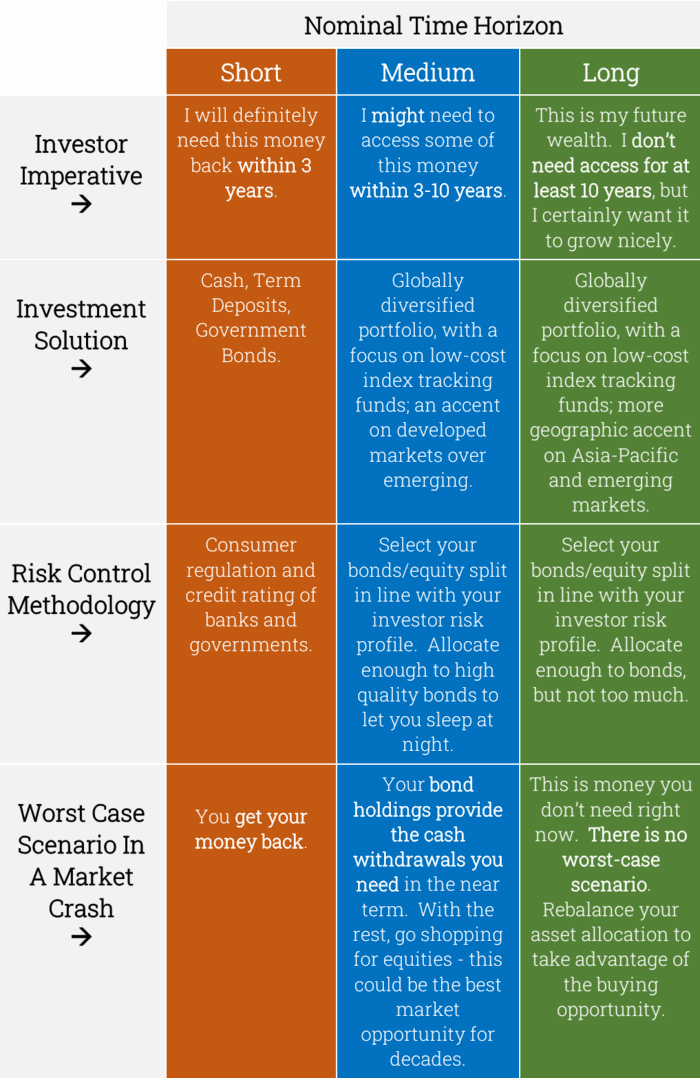

Depending on where we are in our own personal financial life-cycle, perhaps we need access to funds for retirement funding, or perhaps major purchases. In this case, we should already have made sure that the ‘safety’ part of our portfolio covers our needs for withdrawals in the nearer term. The following table is taken from ‘Four Rules for the Calm Investor’ (downloadable here).

As emotional investors, our deepest fear is the worst-case scenario: that our money isn’t there at the time we need to access it. Logically, provided that our near-term cash requirements are covered, cash we don’t need for a while (years, or decades), should stay invested.

Investing New Money

So, what if we have cash on the sidelines right now? When do we invest it?

Well, here’s another logical paradox (or perhaps that should be emotional paradox). As much as we should stay invested during a major downturn (because it removes worry about re-entry and we don’t lock in losses), with new money there’s no harm to wait a bit and see what happens. It’s a perfectly good strategy to keep money off the table, if the table is rattled as if by a tropical storm.

Most investors prefer to risk missing out on a bit of potential upside, rather than misguess the market and experience loss immediately after investing.

Note this doesn’t qualify as ‘timing the market’. If I’m planning to swim upstream in a tidal river, it’s common sense to wait until the tide is in my favour before I dive in. (And to extend the analogue, once I’m swimming, I don’t climb in and out depending on the current.)

Great News For Regular Savers

Another way to ‘capture’ some of the market bottom, without trying to time it precisely, is dollar cost averaging. By disciplined drip-feeding of cash into the markets as they go down, we ‘average down’ the purchase price of our shares, and are guaranteed to see the benefits when prices recover.

Dollar cost averaging is actually an actual thing (with homage to the vernacular of the younger generation). For example, if you had drip-fed money into the FTSE100 monthly, commencing in January 2008 (one of the worst times everrr to invest), by April 2011 you’d be up 18%, However if you had put all your money in in one go, 40 months later you’d only just be breaking even.

Wisdom of Crowds

Stock-markets are a ‘prediction machine’, and second-guessing of the future is what creates volatility, overlayed on top of normal economic cycles.

At any moment, the share-price of a company represents the collective opinion of thousands of market participants. This explains the ‘priced-in’ concept. If market participants generally expect bad news in the upcoming future, share prices will likely fall in anticipation. The bad news is already priced-in.

For the same reason, a stock-market bottom can occur before the end of a recession. This is another reason why market-timing is imperfect, even if called by economists (ahem); by the time the data are in and everyone is saying “Oh yeah, this is a recession”, prices already have the bad news baked in, and shares are suddenly realised to be good value. That’s why strong performance-bounces off the bottom are the norm.

Analysis of the S&P500 during the seven USA recessions between 1973 and 2020, carried out by Vanguard (“Why Investors Should Not Overreact To Talk Of A Recession”), showed that:

“In all cases, the stock market began to recover even as the economy continued to shrink.”

Need a Financial Advisor? Please contact me.