Markets have been pumped up by cheap money. Low interest rates have two key effects (i) the cost of borrowing for businesses is low, supporting earnings, and (ii) investors veer more toward stocks, because bond yields are low.

Altered Reality

Since the start of the outbreak, there has been a kind of suspension of reality regarding the global economic effects of COVID-19. Yesterday, reality landed with a bang - it’s clear that the new coronavirus has not been contained in Asia, and will have a global impact. The IMF has said that the world’s modest GDP growth forecast of 3.3 percent for this year will be effected, but it’s too early to have any accurate figures. The talk is of whether the impact will be ‘V-shaped’ or ‘U-shaped’; the latter being a more drawn-out recovery.This Time It's Different

On the BBC global news podcast (which is the news I wake up to every day), I’ve heard various experts describe how ‘containment’ won’t work, because of the nature of virus, which is named “SARS-CoV-2”; (“COVID-19” is the name of the disease).- People can be infected with the virus and not show major symptoms (so for example, heat cameras at airports, used during the previous SARS outbreak, are ineffective).

- The incubation period is not known for sure; evidence is emerging that it could be much more that two weeks in some cases, and a 14 day quarantine period may not be enough.

- There is not a quick and simple way to test a person for the virus.

- We don’t have a solid understanding on all the mechanisms by which the virus spreads.

- It is uncertain whether having had the virus once will provide future immunity.

Meanwhile, we hear stories that Apple iPhone factories are closing, Jaguar is bringing car parts back from China in suitcases, millions of Chinese small and mid-sized companies will run out of cash within a couple of months, and cities of thousands in South Korea and Italy are in lockdown.

As private investors, how should we process this information, and what action should we take?

What Should I Do?

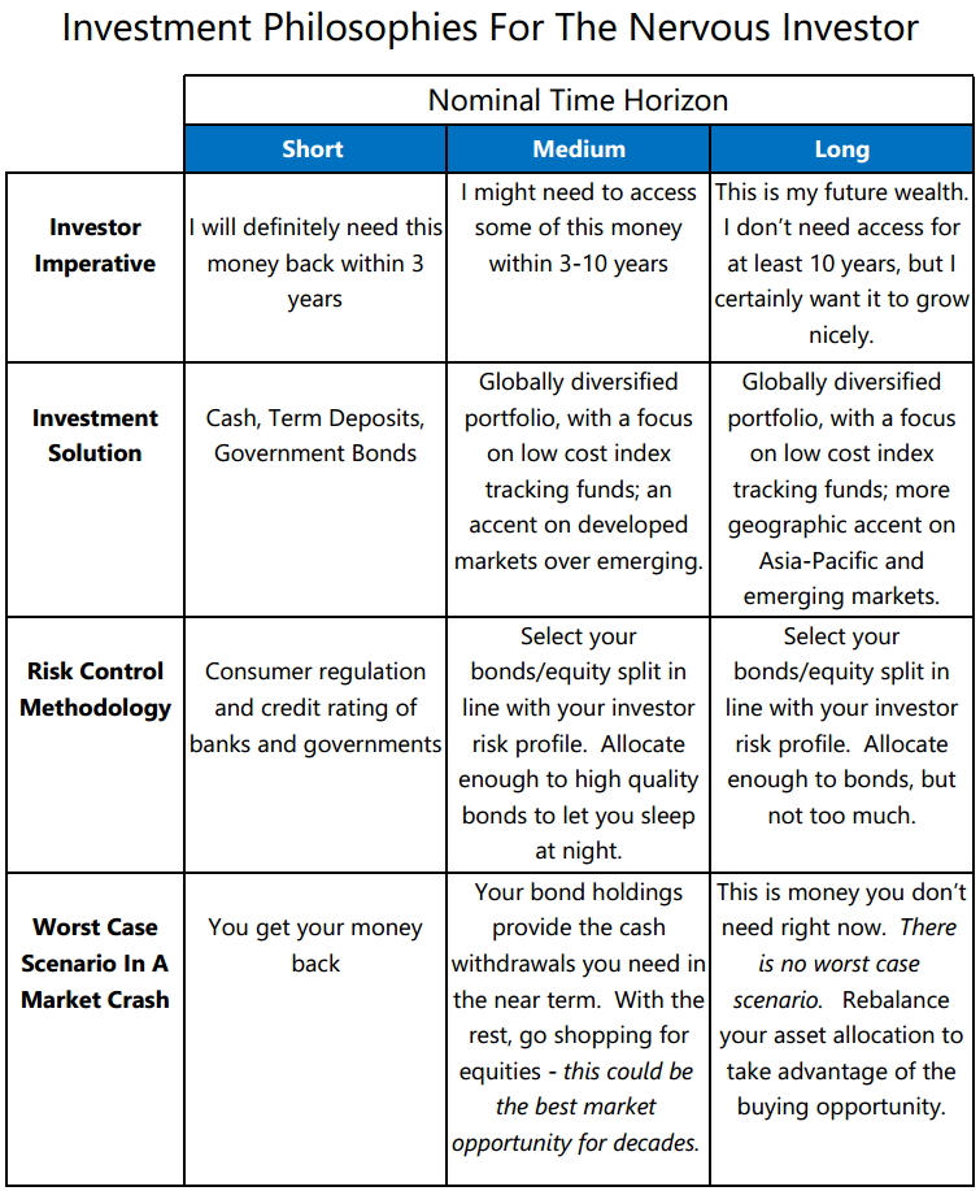

Firstly, let’s remind ourselves of the mantra of the ‘Sage of Omaha’: we don’t buy or sell stocks based on the day’s headlines. The global economy will recover. Investment is a long-term proposition.What’s important is that we step away from emotion and knee-jerk responses, and trust in our overall investment strategy.

A Young Investor

If you are a relatively young investor (well, most of us are, compared to Mr Buffett), saving for retirement, a stock-market correction is a good thing. It means prices of the stocks that you are buying with your monthly savings are low; this is a great situation to be in.A (Ahem) Not Young Investor

If you are a retiree, or perhaps an older investor with half-an-eye on retirement, we can relax because our investment strategy covers us for the downside. The start point is always to think to oneself: “If there was a major market crash right now, how much money would I need to live on for at least three years?” Whatever that number is, that sum should be in government bonds or cash. So, if the worst case actually happens, your financial needs can be met without having an impact on the longer-term growth-oriented part of your portfolio. This is important – stay in the market. After the global financial crisis, from March 2009, the S&P 500 grew 85% in three years.And finally, if you are not yet in the market, or are poised to make a new investment, there may well be some buying opportunities ahead.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"