Figure: Investor Emotion

Given that each of us implicitly understands the single most important rule of investing - Buy Low, Sell High - how can it be that the vast majority of the investing public behave in such an irrational way? And, what can we do about it, as individual investors?

Lessons From Behavioural Finance

Behavioural Finance is the field of study that overlaps psychology with conventional financial theory, to help provide explanations for why investors behave illogically so much of the time. Over recent years behavioural finance has given us some useful insights about how emotions can make us self-destructive investors.There is a very extensive range of behavioural traits that most people exhibit instinctively, and many of us find these difficult to control even though we are aware of the massive roadblock they place in our path to wealth creation. One of the most profound traits is the inability to remain detached from the market’s manic fluctuations, even though our time horizon may be years into the future.

Zoom-In Versus Zoom-Out

Imagine you are starting out on a long car journey, say from London to Glasgow which is a distance of about 650 km. After a short drive (whilst you are still in central London) you hit a traffic jam. Perhaps it’s just sheer volume of road users, perhaps there’s road-works ahead, or maybe an accident. What is your reaction? Do you become stressed and anxious about the delay or detour, or do you sigh resignedly and try to find a radio station with better music?If you are the kind of person who ‘zooms-in’ closely to the here-and-now, then maybe you’ll get stressed by the cost of a few minutes. But for most of us (and we’ve all been in similar situations) by mentally ‘zooming-out’ to the big picture of the whole journey, we know there is no value in getting upset about a delay that is trivial in the context of the day’s drive ahead.

Moreover, if we are on a journey of 8 or 10 hours, we might casually monitor progress every 30 minutes or so. We certainly wouldn’t be checking the odometer every two minutes.

Be A Zoom-Out Investor

We need to zoom-out to see current events in the context of our long term objective. And additionally, we need to make our attention span appropriate to the time horizon of our plan. There's really no need to check your retirement plan more than once a quarter, at most.Stockmarkets typically behave in cycles, and underneath of the daily ups and downs, in the long run markets rise. Notwithstanding, every few years something ‘bad’ happens.

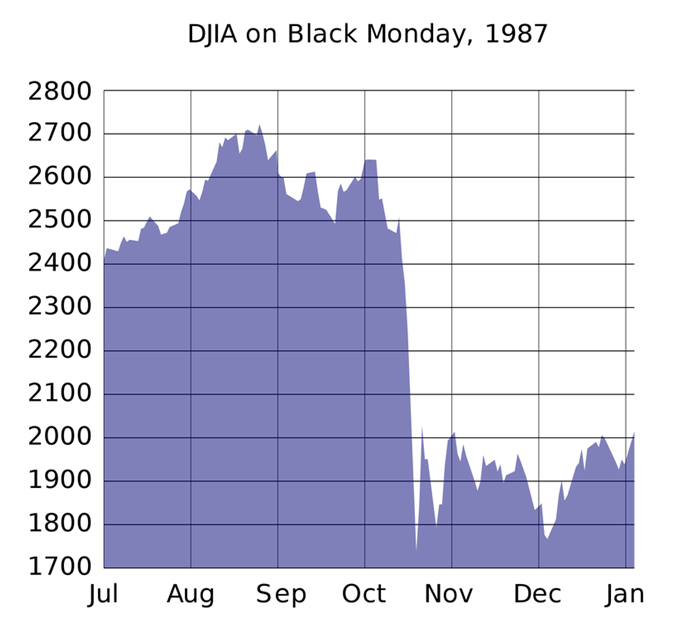

Remember the famous ‘Black Monday’ crash in 1987?

Here’s a zoomed-in chart of the Dow Jones Industrial Average around that time..It looks scary, and it was. I was in my twenties and had already started buying shares. It hurt, and for almost two years afterwards I didn’t even pick up the phone to my broker (no WWW in those days!).

With hindsight, I should have sold my car to buy shares.

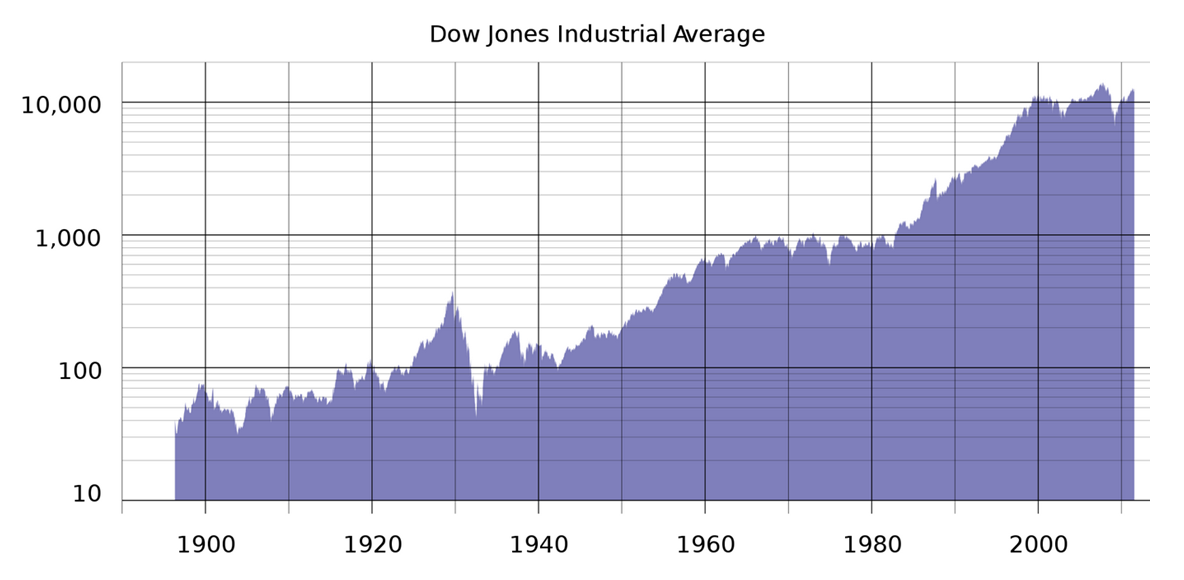

Now let’s zoom-out. How easily can Black Monday be discerned?

Here’s another question. Looking at the chart above, for any ten to fifteen year timescale pretend that a magic genie will grant your wish to invest on any specific previous day you choose.

When would you choose to invest - at the peaks or in the crashes?

Why You Should Pray For A Market Crash

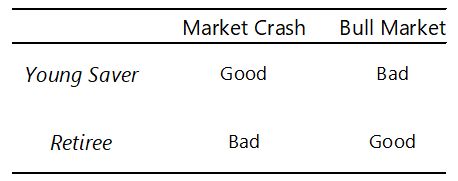

As William Bernstein says in his book “The Four Pillars Of Investing”:A young person saving for retirement should get down on his knees and pray for a market crash, so that he can purchase his nest egg at fire sale prices.

If you are long term saver and investor, which scenario should your prefer: stocks rising dramatically and then staying at high prices whilst you are saving, or falling dramatically and staying at low prices whilst you are saving?The correct answer is the latter; we want prices to be low during the early stages while we are accumulating shares, so that we can buy more. In the years ahead when looking at valuations, future share price rises will be much more beneficial because we’ll be holding a bigger quantity of shares.

(Warren Buffett, in his 1997 letter to Berkshire Hathaway shareholders, also phrased the same question in an entertaining way)

Bernstein lays it out clearly for us:

Dollar Cost Averaging Really Does Make A Difference

It’s all very well ‘knowing’ that a share price dip is logically a good thing, but that still may not quell the urge to simply bail out of investing and go fishing, rather than live with the sickening pit-of-stomach feeling of making a financial loss (on paper), with the potential for more to come.This is where Dollar Cost Averaging (DCA) helps the investor in the emotional sense as well as in the mathematical sense. By regularly drip-feeding money into the markets, regardless of price movements, we reduce market-timing risk and guarantee that our net purchase price will be below the long term average.

Equally importantly, an investor with a proper understanding of Dollar Cost Averaging will be calm as prices fall – he (or she) has all fingers crossed hoping that prices will remain depressed for a long time, giving a chance to accumulate shares at a discount. He knows this will amplify his profits when ultimately the market displays mean reversion and recovers upwards.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"