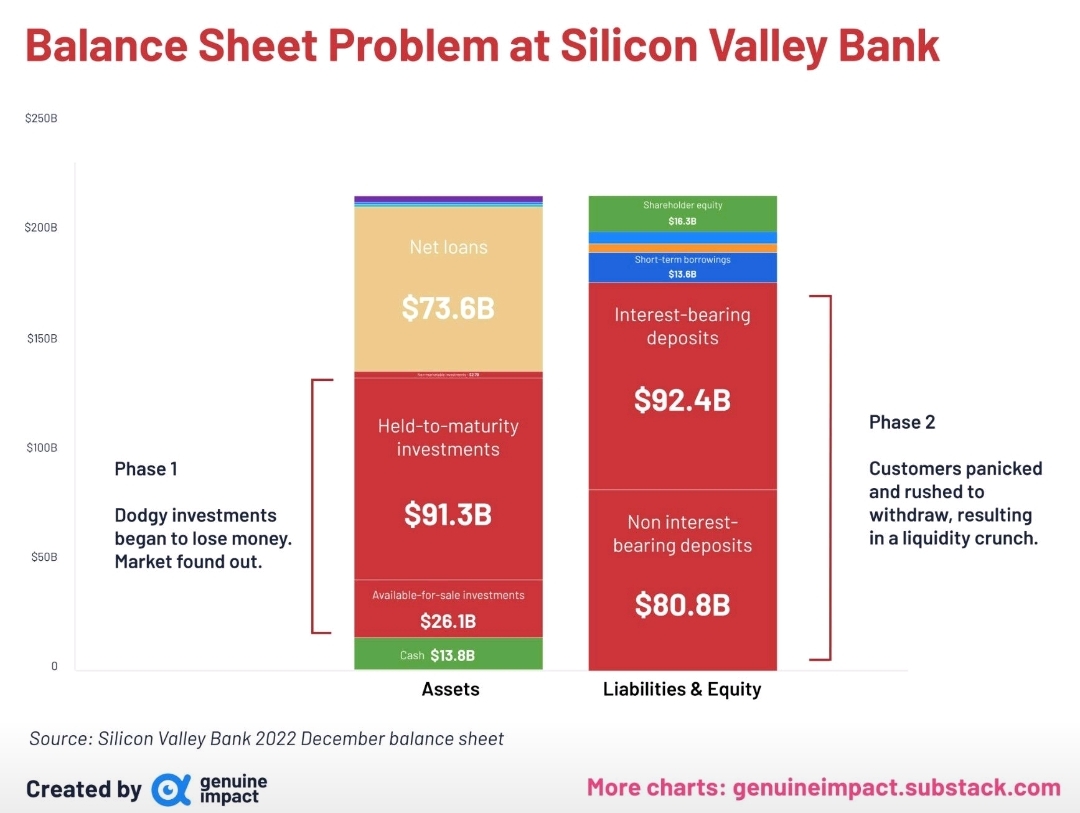

16/3/2023. Imagine you suddenly needed cash, a sizeable amount. But the only asset you hold is long-term – your house. And worse, the property market is really depressed right now. This is a good analogue for the situation SVB (Silicon Valley Bank) found itself in.

Understanding the ‘Held-To-Maturity’ problem.

Banks buy financial assets to hold on their balance sheet, to ensure their liabilities to deposit-holders are covered. Banks often hold a large portion of bonds.

Simple guide to how a bond works

When you buy a bond, you are loaning money to the bond issuer. A bond has a ‘face value’ and a ‘coupon’ payment. So for example I could pay $10,000 for a new 30-year bond with face value $10,000 and coupon of 2.5%. This means that in 30 years I get my $10,000 returned, and each year I hold it, I receive a coupon payment of 2.5%, i.e. $250 annually. Seems like a good idea if you are a looking for a safe long-term investment, right? Certainly, USA banking regulations allow banks to hold this kind of asset on their balance sheets.

How bonds get affected by interest rates

But what happens when inflation spikes and the Federal Reserve and other central banks decide to raise interest rates as a way to cool demand, hence lowering inflationary pressure?

Suppose I am a company looking to issue (sell) bonds today to raise capital to fund my business. Bank interest rates are significantly higher than they were eighteen months ago. So if I want investors to buy my bond, instead of offering a 2.5% coupon, I now need to offer a 5% coupon – otherwise nobody will buy my bonds because they can get a better deal elsewhere.

So far, so good.

Now, suppose instead I am someone who already owns bonds that I bought last year, with face value $10,000 and coupon 2.5%. Even if I had originally planned to hold for the full thirty years, for some reason I need cash right now, so I have to liquidate those bonds.

Well, can’t I just sell my bonds for the $10,000 face value? Nope. The open market will have other ideas.

Remember that a bond purchaser can buy a new $10,000 face value bond right now with 5% coupon ($500 annually). Why would he or she buy your second-hand bond with only 2.5% coupon? As far as the open market is concerned, the bond you hold is now only worth perhaps $5,000 (this is for hypothetical illustration only – there’s a lot of maths behind bond pricing).

This is the ‘held-to-maturity’ problem with bonds. Whilst long term bonds may seem a good safe investment, if they need to be converted to cash in a poor interest-rate environment, you’ll lose your shirt.

What does it mean for other banks?

Now that investors are intensely aware of the potential problem with held-to-maturity bonds on a bank’s balance sheet, every bank is under scrutiny. Yesterday, it was Credit Suisse under the spotlight, with shares hitting an all-time low. The investor Saudi National Bank said it wouldn’t provide any further financial assistance. So the Swiss National Bank stepped in and promptly announced it will lend $53bn to Credit Suisse to ensure that the magical ingredient of ‘trust’ is maintained in the market.

Should I make any specific changes to my portfolio because of the turmoil in the financial sector?

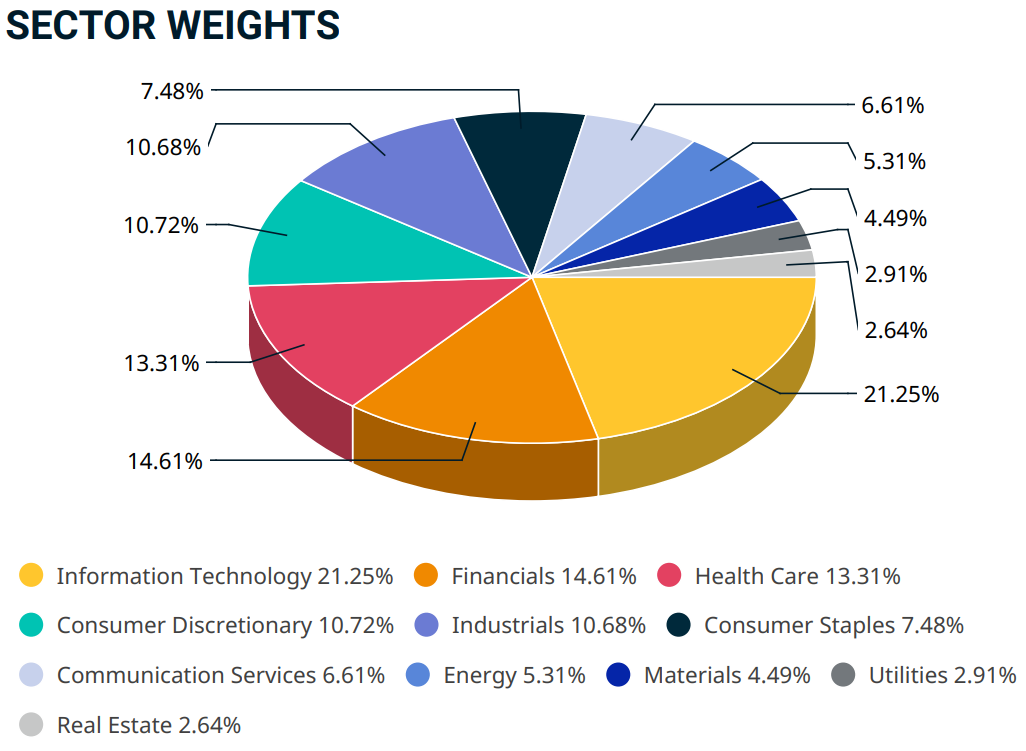

For my clients reading this, the answer is almost certainly no, we don’t have investments that are uniquely focused on banks. Of course, the financial sector is an important component of major developed markets, and thus a natural part of portfolio core holdings. But we shouldn’t be picking apart our portfolio at the seams.

For example, a tracker in MSCI World Index (or equivalent), is a very common core equity holding. The Financials Sector accounts for about 14%.

Source: https://www.msci.com/World

Could the banking sector problems cause broader contagion? Should I change my Portfolio?

With so much background concern over forthcoming recession, negative surprises make markets jittery. As mentioned earlier, governments and central banks know that trust is key.

We can’t predict the future. We don’t make knee-jerk reactions to scary headlines (and remember that a financial journalist's instinct is to write scary not boring). Instead we follow the basic rules proven over generations: maintain enough cash holdings in case of a worst case scenario, and with other assets keep a long-term investment strategy, in line with our investor risk profile.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"