10/7/2022.

- The recent FCA Section 166 report gives Fundsmith a clean bill of health with no action required.

- Outflows over the last few months are not unexpected in the broader market context.

- Fundsmith can have a strategic role to play in many portfolios.

What’s Fundsmith?

Fundsmith is an investment management firm founded in 2010 by Terry Smith. Their flagship fund is ‘Fundsmith Equity Fund’ (which is often referred to simply as Fundsmith).

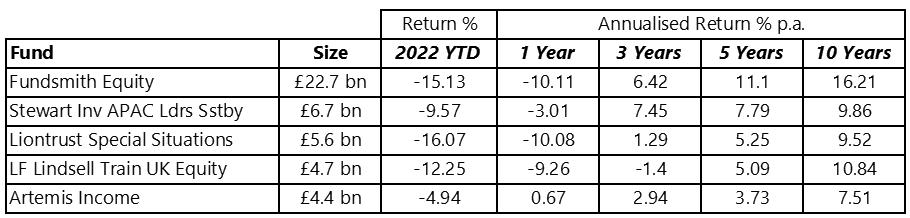

As of 30th June 2022, Fundsmith Equity had assets worth £22.7 billion, making it the largest actively-managed equity fund in the UK. In fact, it’s bigger than the next four largest funds put together.

Figure: UK’s Largest Active Equity Funds

Is Fundsmith A Good Investment?

The size and popularity of a fund is meaningless without context. We need to consider the role an investment plays within our portfolio. Examining the Morningstar categories of the funds in the earlier table underlines why we should compare apples with apples.

- Fundsmith Equity - Global Large-Cap Growth Equity

- Stewart Inv APAC Ldrs Sstby - Asia-Pacific Ex Japan Equity

- Liontrust Special Situations - UK Flex-Cap Equity

- LF Lindsell Train UK Equity - UK Large-Cap Equity

- Artemis Income - UK Equity Income

Global - means that the fund is not restricted to investments from one specific country or region. The current breakdown of Fundsmith Equity is about 74% North America, 21% Europe (ex UK), and 4% UK.

Large-Cap - means that stocks held tend to have high, or very high, market capitalisation. As of December 2021, the average market capitalisation of Fundsmith Equity holdings was £140.7 bn.

Growth - means that the fund manager's investment 'style' tends towards growth over value.

Generically, 'Growth' stocks are those companies that are considered to have the potential to outperform the overall market over time because of their future potential. 'Value' stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return. (Source: Investopedia .)

Fundsmith has it's own definition of Growth, laid out clearly in the ' Owner's Manual '. This is a trail-blazing document as far as manager-to-investor communication is concerned. If Fundsmith is on your radar and you are considering to buy, sell, or hold, this is invaluable reading.

"The businesses we seek must have growth potential. It is not enough for companies to earn a high unlevered rate of return. Our definition of growth is that they must also be able to reinvest at least a portion of their excess cash flow back into the business to grow while generating a high return on the cash thus reinvested. Over time, this should compound shareholders' wealth by generating more than a pound of stock market value for each pound reinvested." Source: Fundsmith Owner's Manual, page 8.

How does Fundsmith rank against it's benchmark?

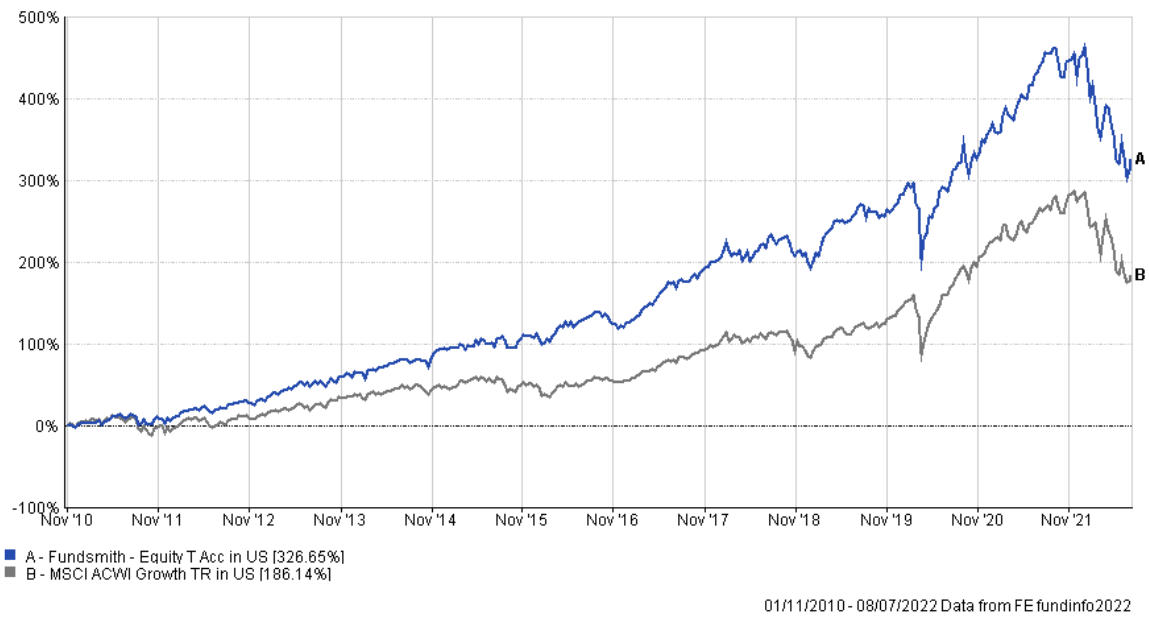

Morningstar offers the MSCI ACWI Growth (All Countries World Index, Growth) as the benchmark for the Global Large-Cap Growth category. Let's see how Fundsmith has compared against this index.

Since it's inception in 2010, Fundsmith Equity Fund has delivered 326% total return, versus 186% for the benchmark index. Put another way, Fundsmith would have more than quadrupled your money.

A Focus on Quality

In additional to Growth, Fundsmith accentuates Quality, defined thus:

"We aim to invest in high quality businesses. In our view, a high quality business is one which can sustain a high return on operating capital employed."

Fundsmith is quite scathing of the common approach of examining growth in earnings per share:

"They start talking about growth in earnings per share and other gibberish. Earnings per share is not the same as cash, but more importantly it takes no account of the capital employed to generate those earnings or the return which is earned on it. If all you want from your investments is earnings per share growth, we can provide as much as you need providing you supply us with unlimited capital and turn a blind eye to the returns we are able to generate." Source: Fundsmith Owner's Manual, page 6.

How does Fundsmith fit into a portfolio?

Given the above discussion, we consider Fundsmith as a Global, Large-Cap, Growth-Quality fund. Alright then, how might it fit into our portfolio?

It's important to note that Fundsmith is highly concentrated, meaning that instead of holding shares in hundreds of companies, it holds only 28 stocks. Therefore we might expect such a restricted portfolio to behave with somewhat more volatility than a fund with a larger and more diverse range of holdings. However, a portfolio of 28 companies can still be well diversified, and the predominant industry sectors held by Fundsmith are consumer products (45%), technology and communications (18%), healthcare (23%), financial services (8%) and industrials (4%).

The Fundsmith Equity Fund should be considered a long term hold by investors. Fundsmith says at the top of the fund factsheet: "The company's approach is to be a long-term investor in its chosen stocks. It will not adopt short term trading strategies."

This is underpinned by the pithy strategy summary, on the cover page of the Owner's Manual:

- Buy Good Companies

- Don't Overpay

- Do Nothing.

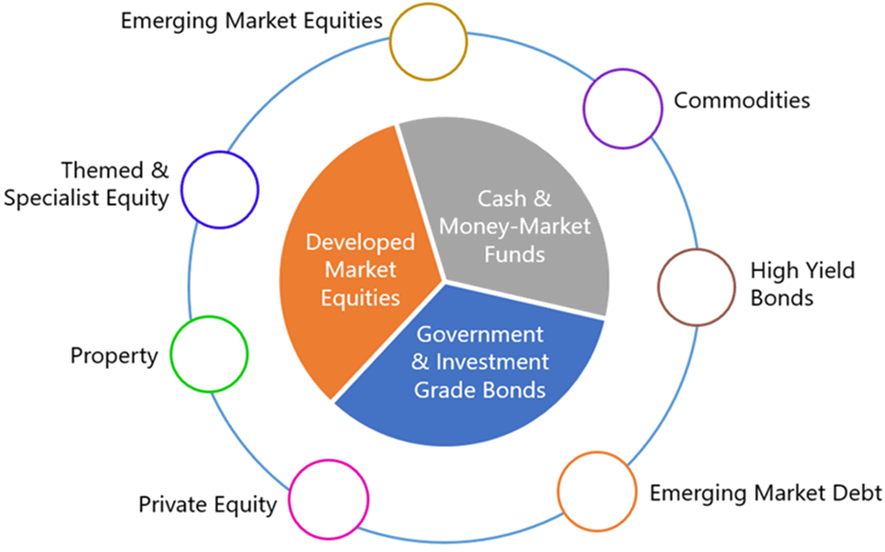

Fundsmith is a Core holding

Referencing the core-satellite portfolio structure, we recall that ‘core’ is generally long-term holdings in quality assets such as developed market equities and investment grade bonds. Whereas satellite holdings tend to be more opportunistic, more bet-like and trend aware, and more regularly reviewed than core.

Figure: Core-Satellite Portfolio Structure, example only.

Fundsmith Equity Fund fits as a core equity holding, but with one important consideration. Because of its characteristics, by owning Fundsmith we are ‘tilting’ our portfolio towards growth stocks. Such an approach can enhance performance, but the volatility of growth stocks can be amplified when compared with a blended portfolio.

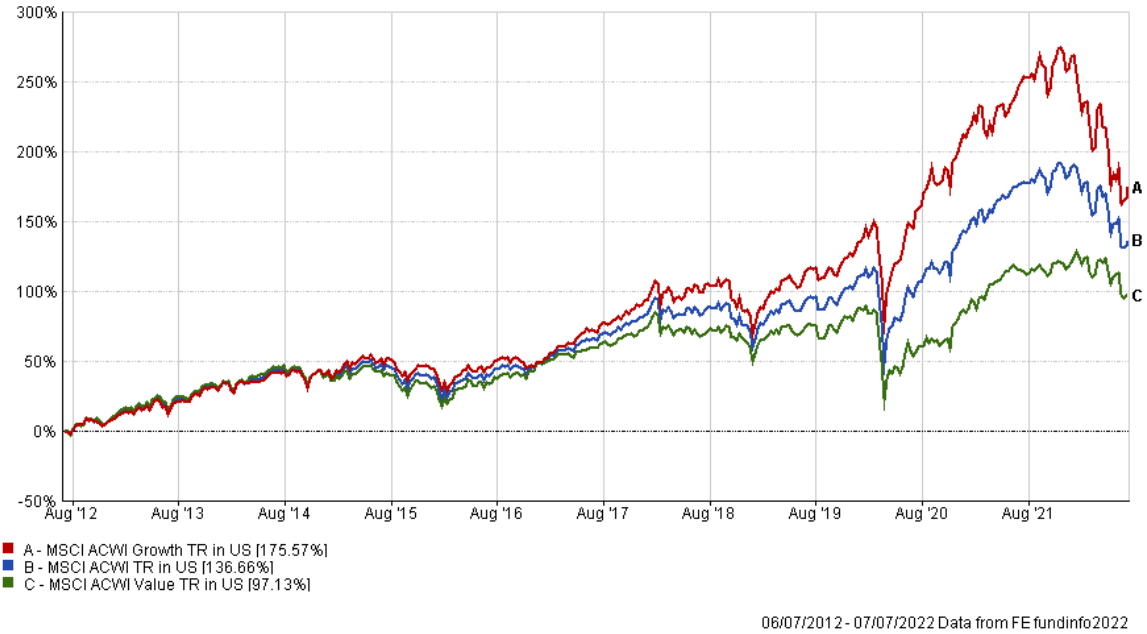

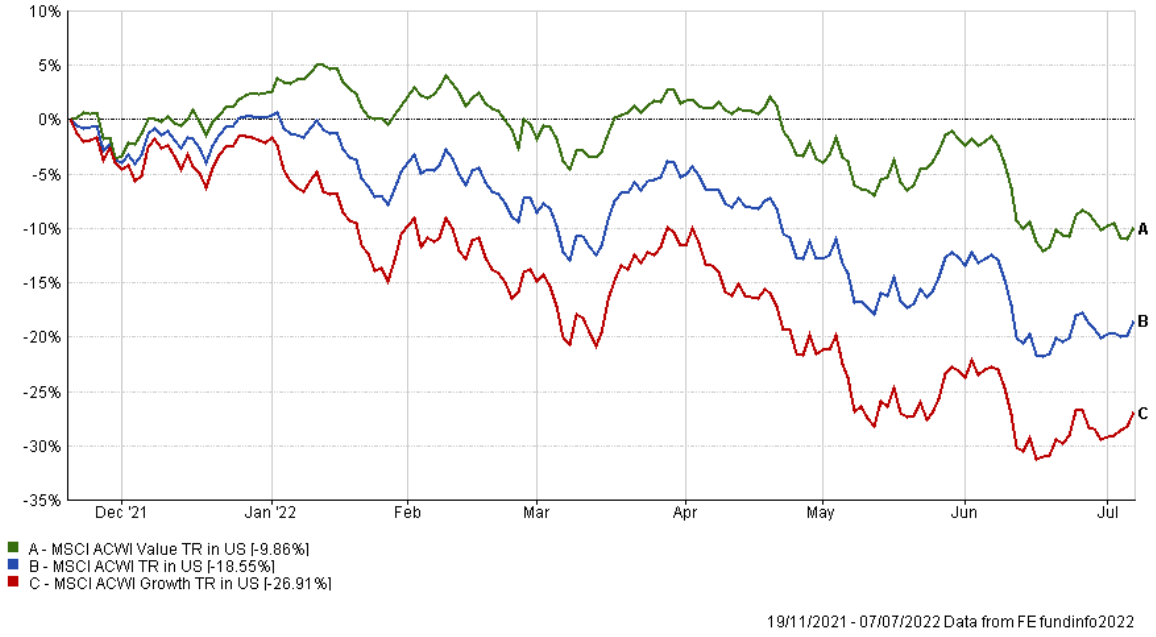

This effect is easily seen by comparing the growth and value versions of the MSCI ACWI (All Countries World Index).

Figure: 10-Year Performance of Growth & Value versions of MSCI ACWI.

An accent on growth can give outperformance when times are good (and has done for several years), but significantly more drawdown when they aren't. In this context, the negative 15% pullback of Fundsmith since the start of 2022 isn't a surprise.

With this in mind, unless we are very comfortable with volatility, Fundsmith probably shouldn't be the primary component of our core equity holdings. Instead, think of it as a way to add a pinch of growth flavour to the blended equity cooking pot.

I heard Fundsmith was under FCA Investigation?

It's amazing how much emotion can be triggered by choice of words. In April 2022, Fundsmith was "served a Section 166 Notice by the Financial Conduct Authority". For the layman, such language might conjure up images of sharp-suited government officials swooping into offices and scooping up documents into brown cardboard boxes.

The reality is rather more mundane. A Section 166 report, also known as a ' skilled person review ', is not an investigation. It's the FCA requesting a review of a firm's operations, carried out by an independent third party (suitably skilled in matters relevant to the review). The scope of such reviews can encompass a variety of areas where the FCA may have concerns or require further analysis, such as:

- past business and quality of advice;

- adequacy of systems and controls (including compliance and risk management);

- corporate governance and senior management arrangements;

- financial crime including market abuse controls;

- client money and client asset arrangements; and

- effectiveness of control functions.

Neither the FCA nor the firm will release any information about the subject or purpose of the review while it is ongoing. (This is common practice industry-wide and world-wide, especially because if an investigation is focused on anti-money-laundering measures, then publicity about it can result in 'tipping-off' parties who may be involved.) Unfortunately, information vacuums cause uncertainty and investor concern, where there may be no cause.

Why Did the FCA Request a Review of Fundsmith?

Maybe we'll find out more details later, or maybe we won't. But consider the following.

Ever since the 2019 Woodford scandal , the UK regulator, i.e. the FCA itself, has been strongly criticised by many - including mainstream press, industry media , MP's, and high-profile investor advocates.

Gina and Allan Miller, founders of the True and Fair Campaign, have accused the FCA of being Asleep at the Wheel . On 11th March 2022, they wrote a letter to the non-executive directors of the FCA, stating:

"We believe there is an urgent and unanswerable case that the Woodford investigation should not only be conducted by an independent third party, preferably an eminent QC or Judge, but that must also include the conduct of the FCA pertaining to the scandal " (my italics).

Common sense tells us that sooner or later the FCA must request an operational review of the UK's most popular equity fund - if for no other reason than to be seen to be doing it's job.

Incidentally, the FCA requests numerous skilled person reports each year, and 11 during the first quarter of 2022 .

RESULT - No action required

Fundsmith receives a clean bill of health in it's Section 166 review

The report contains various recommendations, but the firm has not been instructed to take any further action. This is in line with the earlier Morninstar analyst commentary :

"It has been revealed that Fundsmith was issued a Section 166 notice by the Financial Conduct Authority in the first quarter of 2022. Fundsmith is not allowed to provide much by way of detail while the process is ongoing, but it does expect to come out with a "clean bill of health."

"Section 166 orders can be issued for a variety of reasons. Here, it may be expected to relate to the operational side of the business, likely regarding proposed guidance from the regulator. The review is being led by four PWC employees and is ongoing.

"There have not been major outflows as a result of this news. We will continue to monitor the situation but currently do not believe that it will have a major impact on the investment side of the business or to ongoing operations.

"It is somewhat natural for Fundsmith to receive additional regulatory scrutiny given its status as the largest UK-domiciled fund, though a Section 166 order does come as a slight surprise. We note that there has never been any enforcement action against Fundsmith."

What's behind the Outflows from Fundsmith?

According to the Morningstar commentary above, outflows from Fundsmith were not because of news about the Section 166 review. So, what then?

The title of Citywire's June review of fund outflows gives a clue: " Fundsmith hit by record monthly outflow as investors ditch growth ". Net outflows are huge, industry-wide:

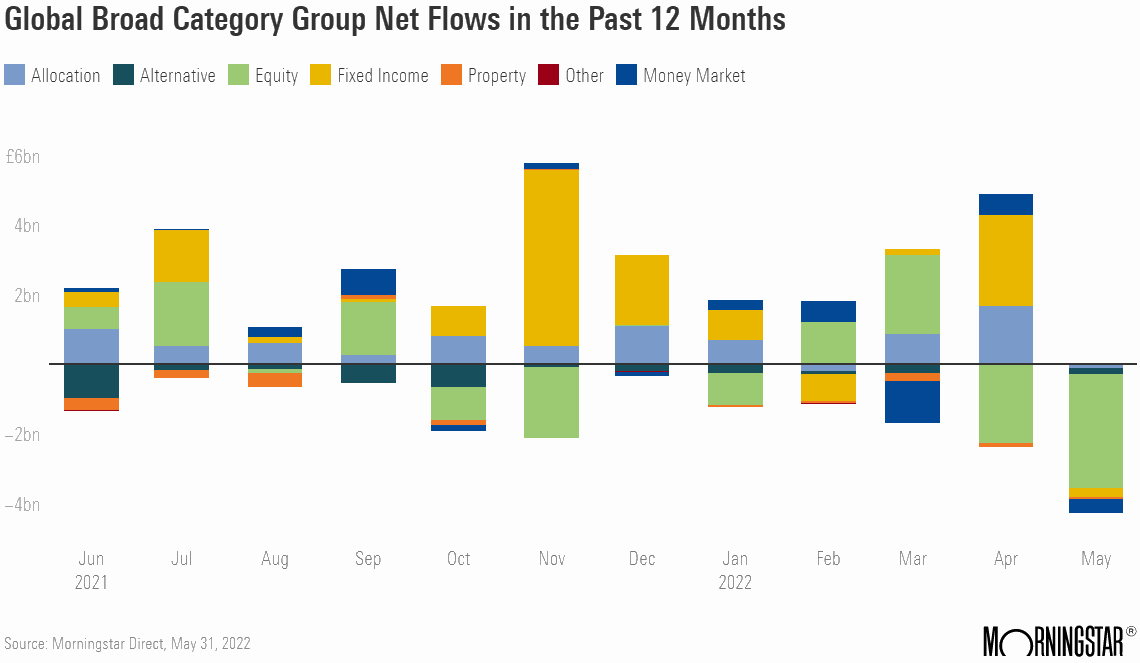

"In terms of fund flows, May was not pretty. Savers pulled a net £4.3bn from UK-based open-ended funds in the month, according to Morningstar, which said it was the worst month since £7.5bn was withdrawn in March 2020 at the height of the Covid crash.

"There were bruising outflows for plenty of fund groups in May, with Aviva, BlackRock and Baillie Gifford all registering net outflows of more than £1bn, according to Morningstar.

The title of the referenced Morningstar article also tells us: " Investors Flee UK Funds as Recession Fears Loom ".

Here's Morningstar's chart of net category flows across the major investment groups.

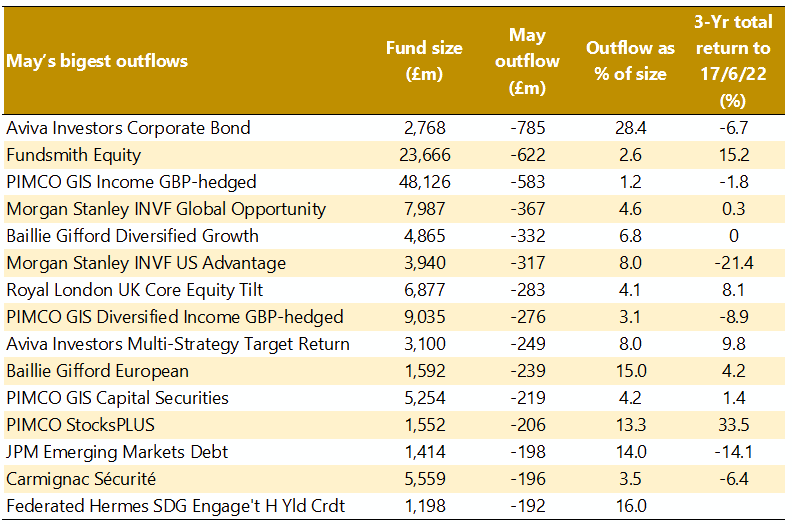

Has Fundsmith’s outflows been much worse than others?

Hardly. Although Fundsmith has suffered ‘record outflows’, it is after all the largest UK-domiciled equity fund. Below is a chart of the 15 funds with the largest net outflows in May. When ranked by outflow as percentage of fund size, Fundsmith is second best, at only 2.6%, against an average outflow of 8.9%.

Conclusion

- Investor sentiment is broadly negative due to risk of recession.

- Net outflows from funds have been correspondingly large, especially for equity funds.

- Potentially, Fundsmith has also been affected by a move away from growth stocks, however, we have no data to support this.

- The FCA skilled person review, requested in April 2022, created an information vacuum while it was carried out by PWC.

- Fundsmith has now received a clean bill of health, with no actions required. The review itself is therefore negated as a specific reason to exit the fund.

- Fundsmith’s investment philosophy - buying quality companies at a good price, and holding for the long term – feels intuitively right and generates popularity and loyalty from investors.

- Fundsmith Equity Fund may have a role, or continued role, to play in portfolios in accordance with investor risk tolerance, time horizon, and investment strategy.

Important disclaimer. This article is for information and education purposes only and is not advice of any kind. Opinions expressed are mine alone and not necessarily those of my employer or any other party.