27/6/2022. SIPP stands for Self-Invested Personal Pension. A SIPP gives you control and flexibility over how your pension savings are invested, and ultimately how you make withdrawals.

A UK SIPP falls under the same regime as other UK pensions, and similar tax rules apply. For expatriates, there are some additional considerations. This article aims to give a broad overview of the key points, without going too much into technical details.

How to Open a SIPP

Any UK resident can open a SIPP, and most UK pension providers make the process easy. However, if you are not tax resident in the UK, there are restrictions on how you can fund a SIPP, and different tax treatments for SIPPs depending on where you live. Due to these operational and compliance requirements, as well as local authorisations needed for promoting schemes in a foreign market, most UK providers will refuse a SIPP application from a non-UK resident.

Fortunately, there are a small number of UK pension providers with international SIPP products that are specifically designed for expatriates (and foreign citizens with a UK pension, having worked in UK in the past). Because of duty-of-care and compliance risks involved in serving international markets, most if not all of these SIPP providers require new clients to be supported by a financial advisor.

Transferring Your Existing Pension(s) to a SIPP

International SIPPs are opened by holders of existing UK pension schemes - which may be either defined benefit (also known as final salary) or defined contribution (also known as money purchase) - to access the better control and flexibility provided by a SIPP. Additionally, because many people acquire several different pensions during their career, a SIPP is useful to consolidate these together under one scheme. Most international SIPPs do not allow additional contributions that are not transfers-in from other schemes, though some do.

Withdrawals from a SIPP – The Basics

Once you are aged 55 or over (or 57 from 2028), you are able to start withdrawing from your SIPP. You do not have be ‘retired’. If you have no financial need for withdrawals, it’s a good idea to keep your pension pot invested and let it continue to grow.

You are allowed to take up to 25% of your pension pot as tax-free cash. Once you’ve taken your tax-free entitlement, remaining withdrawals will be taxed at your marginal rate – i.e. taking account of your total UK taxable income from all sources.

You are entitled to cash in your pension pot in full, which might be appropriate if the total sum is small. For larger amounts, tax considerations are likely to be important.

You also have the option to buy an annuity with your pension pot, although annuity rates have been extremely poor in the last few years, due to low UK gilt rates. However, converting part of your pension to a guaranteed future income could be appropriate depending on your age, health, and the size of your pension pot. Professional advice is important.

Crystallised Pension Drawdown / Income Drawdown / Flexi-Access Drawdown (FAD)

‘Crystallisation’ simply refers to the process of cashing in a pension. You can take a tax-free lump sum of up to 25%, known as a pension commencement lump sum (PCLS), with remaining 75% earmarked (‘vested’ or ‘crystallised’) for retirement income via ‘flexi-access drawdown’ (or for annuity purchase as mentioned above). Flexi-access means you can decide the frequency and level of regular income and/or ad-hoc lump sums. Such pension payments will be taxed at your marginal income tax rate (without National Insurance liability).

Another form of income drawdown, known as ‘capped drawdown’, was closed in 2015. You can still use capped drawdown if you had it established prior to then.

Uncrystallised Funds Pension Lump Sum (UFPLS)

As an alternative, you could choose to take your tax-free entitlement gradually, a bit at a time. Through the Uncrystallised Funds Pension Lum Sum (UFPLS) method, each time you withdraw funds from your pension pot, 25% of it is tax free, and 75% is taxable. Note there’s no PCLS element to a UFPLs withdrawal; UFPLS is a way of making cash withdrawals without designating funds as crystallised to be available for drawdown.

Tax Considerations

If you live in the UK, the taxable part of your pension withdrawals are taxed as income at your marginal rate - so it’s important to understand whether those withdrawals will push you into a higher tax band, when combined with your other income. Depending on your circumstances, rationing withdrawals may be more tax-efficient than a larger amount in one particular tax year.

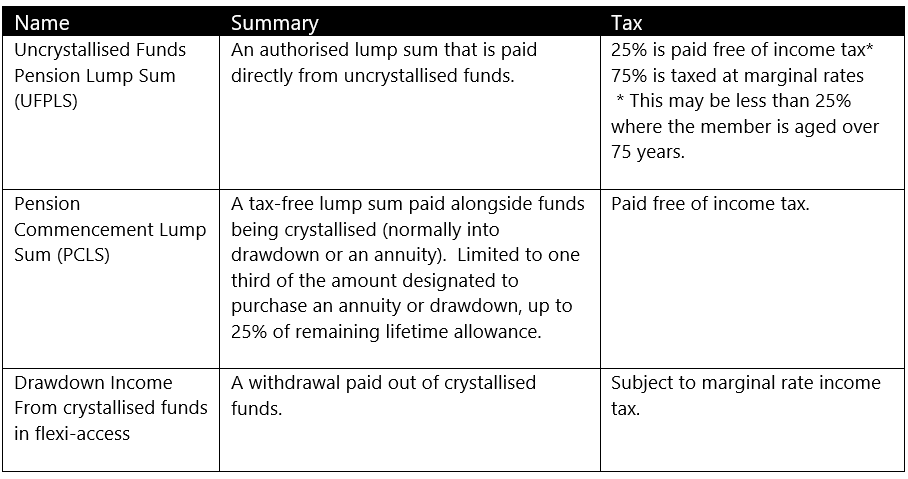

Here’s a table briefly summarising the taxation of your pension withdrawals.

Withdrawals from your Pension when you Live Abroad

Legacy Planning with your UK Self-Invested Personal Pension

If You have a Larger Pension Pot – The Lifetime Allowance (LTA)

- 55% if you take your payment as a lump sum;

- 25% if you take it any other way, for example pension payments or cash withdrawals.