24/1/2022. What Is Blockchain?

There’s already gazillion web pages on blockchain. If you want a palatable introduction that covers the basics well, try IBM’s ‘Blockchain for Dummies’. I like their business-oriented description:

Blockchain defined: Blockchain is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (intellectual property, patents, copyrights, branding). Virtually anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved.

Why blockchain is important: Business runs on information. The faster it’s received and the more accurate it is, the better. Blockchain is ideal for delivering that information because it provides immediate, shared and completely transparent information stored on an immutable ledger that can be accessed only by permissioned network members. A blockchain network can track orders, payments, accounts, production and much more. And because members share a single view of the truth, you can see all details of a transaction end to end, giving you greater confidence, as well as new efficiencies and opportunities.

Bitcoin and Blockchain are Not the Same

Blockchain provides the means to record and store Bitcoin transactions, but blockchain has many uses beyond Bitcoin. Bitcoin is only the first use case for blockchain.

A Gold Analogy

There are several ways to buy gold; or as we say, to get ‘exposure’ to gold. Two popular ways for investors are (i) to buy an ETF that tracks the price of gold, or (ii) to buy an ETF that tracks an index of companies involved in gold mining.

With blockchain, (i) if you wanted to ‘buy’ blockchain, you’re essentially talking about digital assets such as Bitcoin and other cryptocurrencies and tokens. This is a minefield of volatility, low regulation, poor transparency, and scammers.

On the other hand, you can (ii) buy into the technology, through listed companies that are directly involved in the fast-growing blockchain economy. The benefit of this is that such firms are legally transparent, regulated, and audited.

A Small Universe – But Expanding Fast

Compared to the global equity markets overall, there are still relatively few blockchain-economy companies that have gone public. But many firms are in earlier stages of evolution; an expansion of the blockchain investable universe is underway. Hence we’re starting to see more funds and ETFs that are specifically focused on this sector.

Examples of Blockchain-Economy Publicly Listed Companies

Here are a few examples that could be considered as constituents of this sector.

Block Inc (USA)

Recently name changed from Square. Payments systems including crypto.

Canaan Inc (China)

Designer and manufacturer of blockchain servers and crypto mining microprocessors and hardware.

Coinbase Global (USA)

Cryptocurrency exchange and crypto related products.

Hive Blockchain Technologies (Canada)

The first publicly-listed crypto mining company.

Hut 8 (Canada)

Another large crypto mining company.

Kakao (South Korea)

Broad market internet company with business units in games & entertainment, finance & investment, transportation, & social.

Microstrategy Inc (USA)

A business intelligence firm that holds substantial bitcoin assets in it’s treasury.

Monex Group (Japan)

Online securities and crypto exchanges.

SBI Holdings (Japan)

Crypto pooling & digital asset subsidiaries.

Silvergate Capital (USA)

Provision of infrastructure and services to the digital currency industry.

TSMC (Taiwan)

Semiconductor manufacturing including chips used for crypto mining.

Best Blockchain Funds and ETFs

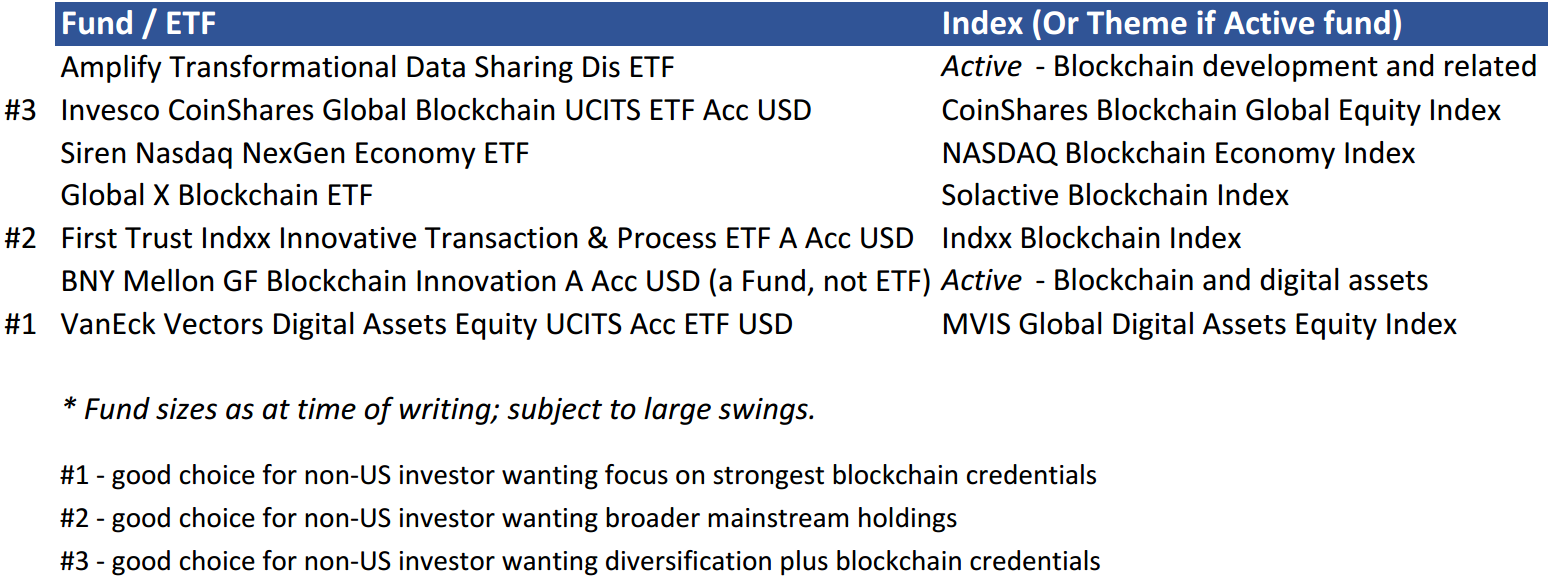

Although the industry is somewhat nascent, nevertheless my research turned up over twenty funds and ETFs that were candidates for a deeper look. This excludes funds that are vehicles for crypto investment (ie funds that track the price one or several cryptos, per my the earlier gold analogy), and also excludes broader Tech and Fintech funds.

No surprises that a majority are domiciled in USA; however a significant number are domiciled in Ireland, which is an increasingly popular location for fund listings.

Aside: What You Should Know About Investing in USA Funds

If you are a non-resident investor in USA stocks, tax law specifies at 30% withholding tax on dividend income. This applies to funds too. However, there is no withholding tax on capital gains. So, in general if you decide to invest in US-domiciled funds, try to prefer funds that pay no dividends, ie “ACC” or accumulation share classes that reinvest income, over share classes called “DIS” (distributing) or “INC” (income).

Your investment platform provider will require you to complete a W-8BEN form, to declare your tax status. If you happen to live in a country with a tax-treaty with the US, your tax liability may be lower than the 30% withholdings.

List of Blockchain Investment Funds

Below is my sample selection of top ETFs (and one traditional fund) for investors seeking exposure to the blockchain economy. (Click image for more detailed table.)

Important Note. This is not financial advice. Commentary is for information and educational purposes only. Investments can be subject to extreme volatility. Always consult your financial advisor.

ETF / Fund name: Amplify Transformational Data Sharing Dis ETF

Ticker / ISIN: BLOK / US0321086078

Fund size: $937m

Number of holdings: 44

Index tracked: Actively managed - Blockchain development and related

Cost: 0.71%

Launch date: 17/1/2018

Domicile: USA

ETF / Fund name: Invesco CoinShares Global Blockchain UCITS ETF Acc USD

Ticker / ISIN: IE00BGBN6P67

Fund size: $780m

Number of holdings: 51

Index tracked: CoinShares Blockchain Global Equity Index

Cost: 0.65%

Launch date: 8/3/2019

Domicile: Ireland

ETF / Fund name: Siren Nasdaq NexGen Economy ETF

Ticker / ISIN: BLCN / US8296582021

Fund size: $231m

Number of holdings: 62

Index tracked: NASDAQ Blockchain Economy Index

Cost: 0.68%

Launch date: 17/1/2018

Domicile: USA

ETF / Fund name: Global X Blockchain ETF

Ticker / ISIN: BKCH / US37954Y1608

Fund size: $102m

Number of holdings: 25

Index tracked: Solactive Blockchain Index

Cost: 0.50%

Launch date: 12/7/2021

Domicile: USA

ETF / Fund name: First Trust Indxx Innovative Transaction & Process ETF A Acc USD

Ticker / ISIN: LEGR LN / IE00BF5DXP42

Fund size: $95m

Number of holdings: 102

Index tracked: Indxx Blockchain Index

Cost: 0.65%

Launch date: 10/4/2018

Domicile: Ireland

ETF / Fund name: BNY Mellon GF Blockchain Innovation A Acc USD (a Fund, not ETF)

Ticker / ISIN: IE00BHPRMN17

Fund size: $95m

Number of holdings: 49

Index tracked: Actively managed - Blockchain and digital assets

Cost: 1.98%

Launch date: 17/5/2019

Domicile: Ireland

ETF / Fund name: VanEck Vectors Digital Assets Equity UCITS Acc ETF USD

Ticker / ISIN: DAPP LN / IE00BMDKNW35

Fund size: $28m

Number of holdings: 25

Index tracked: MVIS Global Digital Assets Equity Index

Cost: 0.65%

Launch date: 30/4/2021

Domicile: Ireland

Analysing Blockchain Indices

As investors, we like tracking an index, because it is rules-based, and (in theory) there is no human intervention behind constituent selection and weightings. For a new and emerging sector like blockchain, the industry is immature, and there are several index providers with different rules and different definitions of the investment universe; and no obvious leader.

We should also bear in mind that in such a fast-moving sector, there may be scope for an actively managed fund to perform better than a certain index. We must therefore dig deeper into the indices, to really get an understanding of the investment thesis of each ETF or fund under consideration.

The applicable indices for the above ETFs are:

• MVIS Global Digital Assets Equity Index

• Solactive Blockchain Index

• CoinShares Blockchain Global Equity Index

• NASDAQ Blockchain Economy Index

• Indxx Blockchain Index

MVIS Global Digital Assets Equity Index – Overview Analysis

“The MVIS Global Digital Assets Equity Index (MVDAPP) tracks the performance of the largest and most liquid companies in the digital assets industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from digital asset services and products, such as exchanges, payment gateways, mining operations, software services, equipment and technology, digital asset infrastructure, or the facilitation of commerce with the use of digital assets. MVDAPP covers at least 90% of the investable universe.”

Number of components (at time of writing): 25

Key components include: Coinbase Global, Silvergate Capital, Microstrategy Inc, Canaan Inc, Hive, Bitfarms

Roy’s thoughts: possibly the index with the strictest focus on blockchain and related activity.

Solactive Blockchain Index - Overview Analysis

The index guideline states that the investment universe comprises mining, blockchain and digital asset transactions, blockchain applications, blockchain and digital asset hardware and infrastructure, and blockchain engineering and consulting services. The highest priority category is pure-play companies deriving at least 50% of revenues from blockchain activities.

Number of components (at time of writing): 25

Key components include: Coinbase Global, Block Inc, Canaan Inc, Riot Blockchain, Voyager Digital, Hut 8

Roy’s thoughts: a significant amount of overlap with the MVIS Global Digital Assets Equity Index, and with only 25 holdings also, potentially as focused.

CoinShares Blockchain Global Equity Index - Overview Analysis

“The CoinShares Blockchain Global Equity Index (BLOCK Index) aims to offer exposure to listed companies that participate or have the potential to participate in the blockchain or cryptocurrency ecosystem. The index aims to capture the potential investment upside generated by earnings related to the adoption of blockchain technologies or cryptocurrency.”

The index guideline states that the investment universe comprises mining (hardware, technology and operations), energy (relevant to crypto mining), token investments, blockchain financial services and payment system, blockchain technology solutions and consulting. The highest priority category is companies with over 50% of corporate value attributable to blockchain technology.

Number of components (at time of writing): 51

Key components include: Coinbase Global, Silvergate Capital, Kakao, SBI Holdings, TSMC, Monex Group, Hive, Bitfarms

Roy’s comments: possibly more genuinely ‘global’ than either the Solactive Blockchain Index or the MVIS Global Digital Assets Index, with twice as many constituents and rather more weighting to international companies including Japan, Taiwan, and South Korea.

NASDAQ Blockchain Economy Index - Overview Analysis

“The Nasdaq Blockchain Economy Index is designed to measure the returns of companies that are committing material resources to developing, researching, supporting, innovating or utilizing blockchain technology for their proprietary use or for use by others.”

Number of components (at time of writing): 62

Key components include: IBM, Baidu Inc, SBI Holdings, Tencent Holdings, Alibaba, Fujitsu

Roy’s comments: somewhat broader index than the Coinbase Blockchain Global Equity Index, with marginally more inclusion of China based firms. Plenty of household names.

Indxx Blockchain Index - Overview Analysis

”The Indxx Blockchain Index is designed to track the performance of companies that are either actively using, investing in, developing, or have products that are poised to benefit from blockchain technology. The index seeks to include only companies that have devoted material resources or made material commitments to the use of blockchain technologies.”

Number of components (at time of writing): 102

Key components include: Micro Technology, Advanced Micro Devices, Microsoft, Accenture, Mastercard, Gazprom, Intel, Samsung, IBM, Tesla, Infosys, Salesforce

Roy’s comments: the least focused blockchain index, with a significant number of household names; almost all constituents are likely included in mainstream equity indices such as S&P500, NASDAQ, and international equivalents. You probably already own most of them.

Conclusion

I have no doubt that blockchain technology will bring a meaningful step-up in business efficiencies, and hence the productivity per capita of nations. Ultimately, blockchain technologies will become naturally embedded in the global economy.

Until then, investing in firms within the blockchain industry is a good way to capture potential upside. Investors need to take a long term view, and be prepared to accept extreme volatility and potentially huge losses.