05/07/2021. 'Home-country bias' is when investors take too much comfort in familiarity of company shares in their home country, paying too little attention to the investment opportunities in other parts of the world. This leads to a poorly diversified portfolio, with an asset allocation that is overweight to the home stockmarket, and underweight on global shares. Such a portfolio is typically higher in volatility, and lower in performance, than a properly diversified global portfolio.

Home-country bias is not unique to any particular country - investors everywhere suffer from the same blinkers. There is a natural tendency to favour companies and brands that we feel we know, because they are local to us. 'Invest in what we know' is a detrimental philosophy in this instance; we should be learning more about global investment markets, and accessing the growth opportunities that are there for the taking.

The negative impact of investment home-country bias is amplified when the domestic economy is small in size, compared to other regions of the world. Investors can favour 'large' local firms, forgetting they may be big fish in a small pool.

Nominal GDP (USD $ billions, latest data, source: CEIC)

- United States - $5374

- European Union - $4063

- China - $3847

- Japan - $1319

- India - $739

- Germany - $1009

- UK - $717

- France - $701

- Canada - $442

- Russia - $407

- Brazil - $377

- Australia - $371

Australian expatriates benefit from the opportunity to buy shares listed on the ASX Australian stockmarket, without liability for tax - as long as those shares are bought and sold whilst the investor is living overseas. But does this mean that an Australian focus is the best option?

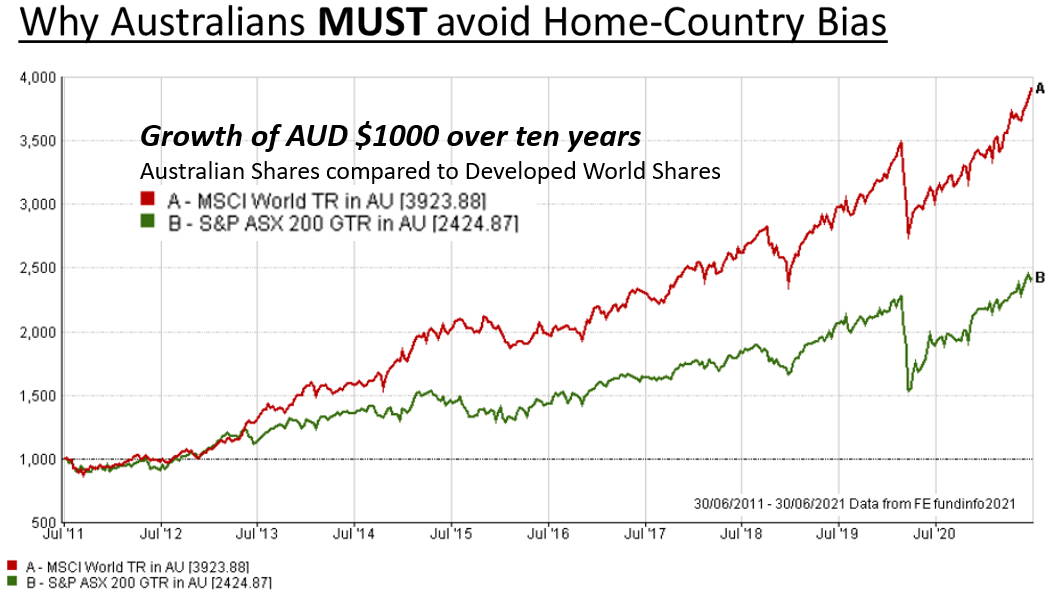

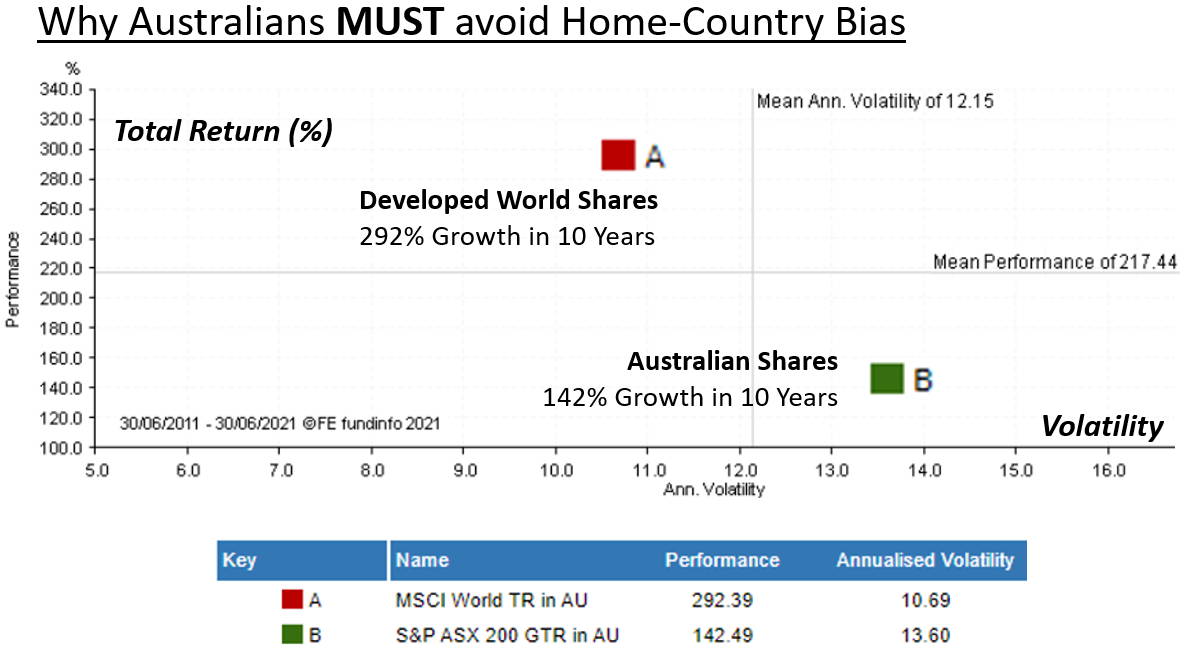

We can easily see the effect of home-country bias for an Australian investor, by comparing the performance of the ASX 200 Index (which tracks the performance of the 200 largest firms listed on the Australian stockmarket) versus the MSCI World Index (which tracks the performance of companies across the developed nations of the world).

As you can see from the chart below, if you had invested AUD $1000 in the ASX 200 in June 2011, it would have grown to $2424 over ten years. However, if instead you had invested in global shares, $1000 would have grown to $3923.

Moreover, poor diversification would have meant that your ASX 200 investment was not only significantly worse in terms of performance, but with higher volatility also.

In the last ten years, the ASX200 has delivered LESS THAN HALF the returns of global shares, and with ONE-THIRD MORE volatility.

For Australians living abroad, tax considerations can be easily set aside using ATO-compliant investment accounts that provide the opportunity for both tax-free gains and tax-free income. To find out more, please contact me.