06/03/2021. Not only are we living longer than our grandparents, many of us hope to retire at a younger age, and, to be fit and active in the early years. A generation ago, a typical retirement lasted about ten years, but nowadays that may be twenty-five years or longer for some of us.

>> Download the Calculator Here <<

Planning for sufficient income to enjoy our retirement to the full is essential. Moreover, we need to ensure that income keeps pace with inflation after we retire - otherwise we may become impoverished as purchasing power is eroded over the years.

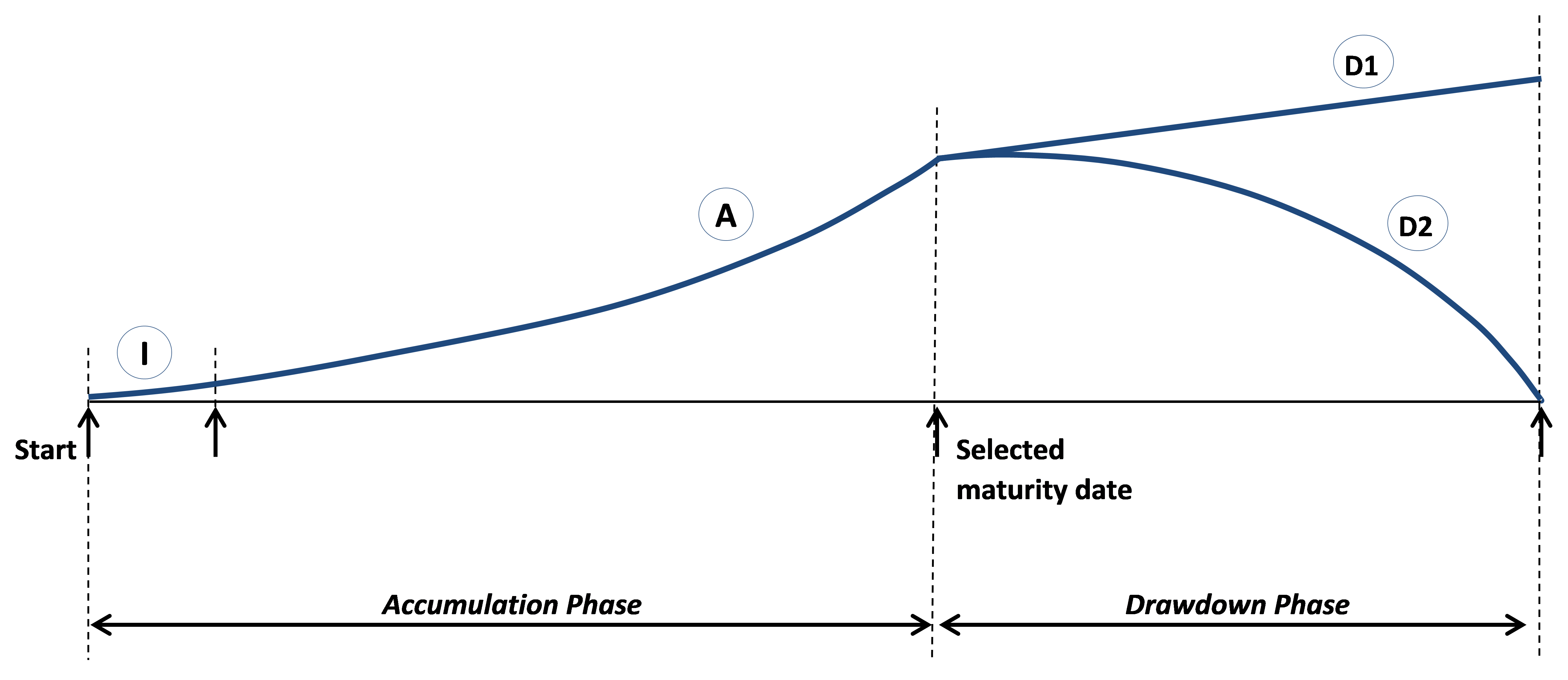

The figure below shows the value of a typical retirement fund over time. During the accumulation phase, the initial period ‘I’ is crucial as the foundation for future growth. Accelerated compound growth comes in the later years ‘A’, as we approach retirement.

Your ideal savings target should be chosen to enable sustainable income drawdown ‘D1’ where each year both your investments and income can grow in line with inflation, for as long as you live.

As a rough rule of thumb, a typical withdrawal rate would be between 4%-5% to give the best chance of your income keeping pace with future inflation, and your pension assets not being run down to zero within the next thirty years. For example, if you wish a retirement income of $40,000 you should plan for a pension fund of $800,000 (at 5%) and ideally $1,000,000 (at 4%).

If sufficient funds have not been accumulated by your retirement date, you will need to ration your income (‘D2’) to try to make it last, so that you don’t run out of money and be forced to become dependent on others such as family. In this situation, 5% is still the absolute maximum withdrawal rate, because it represents an income of twenty years exactly (assuming your fund growth can at least keep up with inflation).

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"