7/3/2020. Short Answers: Maybe, but we can't tell for months. And, probably not.

The popular rule of thumb is that a recession is marked by two quarters of declining GDP. This is a very ‘rear view mirror’ indicator. Helpful for financial headline writers, but hardly useful for governments, central banks, or indeed private investors. You can’t manage policy by looking back in six months’ time, and saying, ‘Oh yeah, that’s when the recession started.’

This week, the US Federal Reserve announced an emergency reduction in interest rates. The reduction of 0.5% was designed to bolster the US economy in view of the risks posed by the coronavirus outbreak, bringing the target borrowing rate to between 1%-1.25%.

This is the first time the Fed has lowered rates outside of the regularly scheduled committee meetings, since 2008 – when we were in the grip of the global financial crisis. The Federal Open Market Committee (FOMC) meeting was next due for 17th/18th March, but Jerome Powell fronted the announcement early on 3rd March. Three sentences:

"The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy."

This begs the question – exactly what tools does the Fed have, in the face of such a threat? The global reaction to the virus is creating shocks on both supply and demand side of the economy. We may have read that auto manufacturers were having problems getting parts out of China; but, when the new James Bond movie launch is delayed by seven months – well, even the average man-in-the-street realises that something serious is going on. So, he stays off the streets. (The oddly prophetic title of the movie is coincidence.)

Let’s be clear, we aren’t facing a zombie apocalypse, but containment precautions and plain old fear has already started to hammer demand globally. Airports and tourist attractions are empty. High profile conferences called off. Sporting events cancelled or postponed (and maybe even the Tokyo Olympics).

Here in UAE, questions are already whispered: what will happen to Expo 2020? Due to start in October, Expo 2020’s whole foundation is the prospect of huge numbers of people from every country in the world coming together over a six-month period to experience an event of “food, music, tech, culture, creativity”. Will the threat of COVID-19 be gone by then? <Shrugs. Looks down at shoes.>

It is now known that ‘containment’ is not possible. But containment strategies do serve to delay the transmission of the virus, for two good reasons: (i) allow medical facilities some extra time to prepare and ramp up capabilities, for treatment of the expected large numbers of infected, and (ii) any delay in global transmission is helpful, as we wait for vaccine development.

President Trump met with pharmaceutical executives this week, and demanded that a vaccine be available by the time of the US election in November. Well, er, it doesn’t work like that Mr President.

Dr Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, laid out the simple truth: “A vaccine that you make and start testing in a year is not a vaccine that's deployable”.It seems to me that from an economic perspective, it will be many, many months before things get back ‘to normal’. And given that the Fed, and other central bankers globally, have few meaningful tools in their monetary kitbag, what does that tell us about the likelihood of recession in the year of COVID-19? This is the question that currently presents every investor. And yet, Mr Powell tells us, the fundamentals of the U.S. economy remain strong. So perhaps governments will open up their fiscal first-aid boxes? Policymakers are already calling for it.

Good economic fundamentals don't mean that prices aren't overheated, or that investors aren't spooked by uncertainty.

The fact that economic data and information flows near-instantaneously within financial markets is a good thing. It means that investors and market participants generally work off the same data, and that share prices are thus ‘fair’ in that they represent what the collective market thinks an asset is worth.The problem is, if we need to wait months or quarters to find out if there’s a recession going on, fear can take over. Sure, there are hordes of financial 'experts', each with their own pet recession indicators and early warning alerts. However, it’s not data, but sentiment that is driving market volatility right now - because markets don’t like uncertainty.

Whilst I wouldn’t be surprised to see another 10% fall in equity prices, we mustn’t make policy decisions about our own portfolio based on sentiment. I also wouldn't be surprised if there was an equivalent movement in the opposite direction.

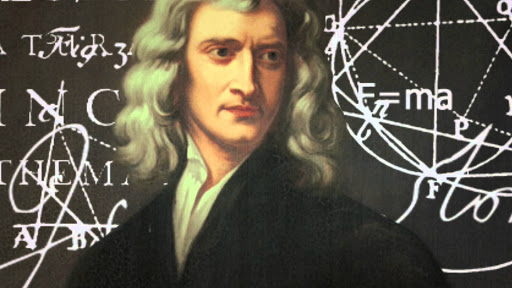

When it comes to portfolio strategy, it’s helpful to draw an analogy to Newton’s First Law: “An object will remain at rest or in uniform motion in a straight line unless acted upon by an external force.”

If we have a rigorously diversified portfolio, in line with our investor risk profile and long-term strategy, and with an adequate allocation to quality bond holdings, then we should never need to make changes to our holdings based on emotion. Sentiment doesn’t count as an external force; data does. And data from decades of research tells us to trust our asset allocation.

A Potential Downturn Hails Opportunity

If it turns out that we are entering a global recession, as markets fall and eventually bottom out, there will be a right time to reach into the back-pocket of our bond holdings, pull out a wad of cash, and go shopping while they’re having a Sale in the stock market.If you are looking for a financial advisor, or a new one, please contact me.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"