26/1/2020. Numerous surveys show an adoption gap between people who are interested in sustainable investing, and people who actually do it.

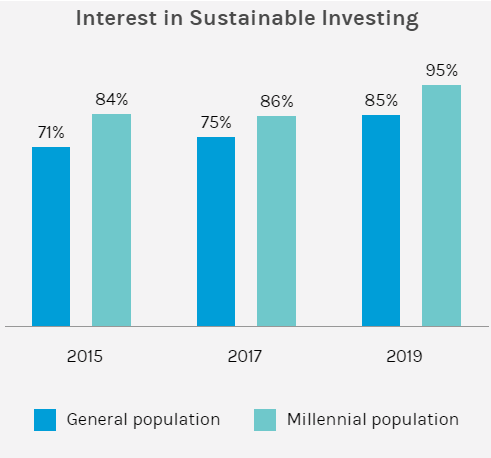

26/1/2020. Numerous surveys show an adoption gap between people who are interested in sustainable investing, and people who actually do it.One survey from Morgan Stanley USA in 2019 showed that 85% of individual investors (and 95% of millennials) are interested in sustainable investing strategies. However, the adoption of some degree of sustainable investing lies far behind, at only 52%.

Why is There A Sustainable Investing Adoption Gap?

Let’s look at some of the reasons for the sustainable investing adoption gap.Sustainable Investing Adoption Gap Reason #1 – Investors Don’t Know How To Start, And Advisors Aren’t Helping Enough

The investment industry offers poor clarity for non-expert, would-be, sustainable investors. There’s a lack of common terminologies, and few standard ratings methodologies for sustainable investing strategies.

Investing sustainability as an ordinary retail investor in 2020 – is still too hard.

Moving from good intent to practical implementation is a difficult leap. At first glance, there seems like lots of information available. But 144,000,000 search results for ‘sustainable investing’ isn’t translating through to enough useful guidance for a non-expert. In Schroders Global Investor Study 2018 Sustainability Investment Report, 57% of investors said that a lack of information and understanding prevents them from investing, or investing more, in sustainable investing.

Helping investors follow a strategy that matches their ethical beliefs should be the role of a financial advisor. But in the 2019 Sustainability Investment Report, 59% of investors said that if their financial advisor provided more, easy-to-understand information on sustainable investments, they’d be encouraged to invest more sustainably.

Additionally, research from Allianz in 2019 indicates that only 20% of retail investors have discussed sustainable investing with their advisor. Moreover, even after raising the subject, only 26% of investors were offered a sustainable investment.

Sustainable Investing Adoption Gap Reason #2 – Poor Availability Of Sustainable Investment Products

Access to sustainable investing products and solutions is not keeping pace with investor demand.

There’s been a surge in sustainable investing in recent years, and in the 2018 Global Sustainable Investment Review, the Global Sustainable Investment Alliance estimated that the total sustainable and ethical investing assets across the top regions of Europe, North America, Japan and Australasia, was about USD $30.7 trillion. This figure is up from $22.9 trillion in 2016.

However, the same report indicates that only 25% of those assets are held by retail investors; 75% of sustainable investment assets are held by institutions.

An investor’s access to sustainable investments depends on the funds being available via his or her investment platform or pension scheme. And in this respect, the investment industry seems to be letting down the private investor.

For example, in 2018 the UK pension industry was GBP £2.2 trillion, second only to the USA in a global pension industry valued at USD $40.0 trillion (source: OECD). But sadly, if you’re a member of a UK company or private pension scheme, and you want to select sustainable investments for your money, you’ll find there are very few choices, or quite possibly none.

Even for most UK SIPP (self-invested personal pension) owners, it’s difficult to invest in line with personal values. For example, the largest do-it-yourself ‘fund supermarket’ in the UK is Hargreaves Lansdown, with more than 1 million investors and £100 billion of assets. Private investors making their own investment choices are guided by the HL Wealth 50 – “our favourite funds across the major sectors” – but the list contains just one ethical fund. Furthermore, the portfolios offered by the HL Portfolio service - “ready-made investing managed by our experts” - contain no ethical or sustainable funds.

A focus on sustainable investing requires an international perspective. International investment platforms and investment bonds provide perhaps the best opportunity to invest sustainably in global markets, currently. Being ‘open-architecture’, the owner can access a truly enormous range of global investments – including company shares from global stock-markets, mutual funds and unit trusts, exchange-traded funds (ETFs), and fixed-income or bond funds, from all major asset managers around the world. This is a perfect tool for serious investor wishing to invest ethically and sustainably (contact me to find out more).

Sustainable Investing Adoption Gap Reason #3 – People Think That Investing Sustainably Necessitates Sacrifice of Returns

As familiarity with sustainable investing rises, this myth is dissolving, but it still exists in the retail investment space. Globally, about a third of people believe that sustainable investments deliver inferior returns compared to non-sustainable investments (source).

The view that ‘sustainable funds weaken my portfolio’ has some foundation, because of the poor access to ethical funds, described above. It is self-evident that if an individual investor only has a few ethical funds to choose from, he or she probably won’t have access to the full range of the best ones. This is a powerful disincentive, because surveys show that although sustainability may be top of mind for investors, they still prioritise returns.

Additionally, the more a portfolio is focused on ethical or sustainable investments, the more care must be taken with asset allocation and fund selection, to avoid the risks of concentration and holdings overlap. Depending on the universe of funds available on his or her platform, it may not even be possible for a retail investor to construct a well designed and diversified fully sustainable portfolio.

But the holy grail of market returns from a 100% ethical and sustainable portfolio does exist. There is academic research demonstrating the business case for ESG investing, with a positive ESG impact on corporate financial performance (source: Journal of Sustainable Finance & Investment).

Furthermore, whilst sustainable funds can provide returns in line with traditional funds, they may also reduce downside risk and are more stable in periods of extreme volatility, according to Morgan Stanley Institute For Sustainable Investing, and Morningstar. Research from MSCI suggests that higher ESG-rated companies may have higher profitability and dividends, better risk management practices, and a lower risk of severe incidents.

Sustainable Investing Adoption Gap Reason #4 – Investors’ Money Is Not Applied In The Way They Think It Is

Last week I attended the Abu Dhabi Sustainable Finance Forum (which incidentally was so well attended there was only standing room left at the back of the auditorium). Many of great and the good of the sustainable investing universe were either speaking or on panels. One thing that struck me was the number of times greenwashing was raised as a concern. If institutional finance experts worry about greenwashing, then for sure it should be a major issue for retail investors.

‘Greenwashing’ is the marketing practice of enhancing the perceived sustainability credentials of a product. Greenwashing of retail goods, household products and foodstuffs has been around for many years, because it’s well known that consumer are prepared to pay more for sustainable brands. Manufacturers of everything from cars to coffee have been accused of greenwashing.

In the competitive world of investment products, it’s no surprise that greenwashing has become more and more prevalent. To be blunt, it’s a sneaky (some might say downright dishonest) way to capitalise on the surge of demand for socially responsible investment products.

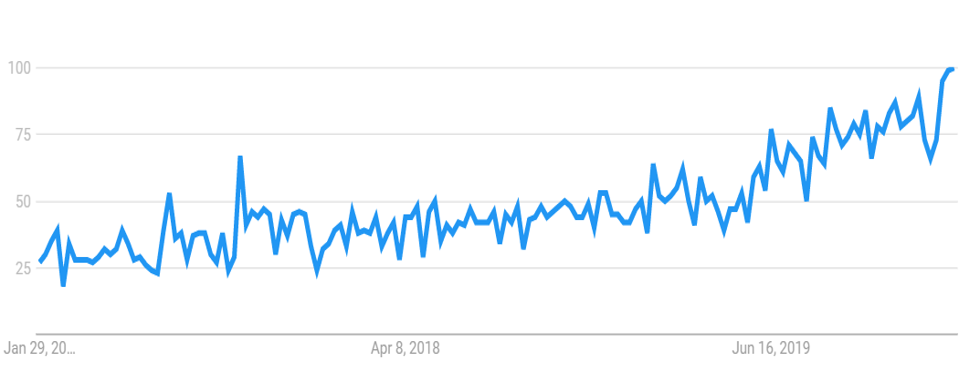

Investors are becoming more familiar with terms such as “ESG” (Environmental, Social and Governance factors), and Google says that popularity of the search term “ESG” is now 400% that of just three years ago.

Figure: Worldwide popularity of search for “ESG”, three years to 25-Jan-2020.

Source: Google Trends. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

The problem is that ESG is only a framework for categorising and analysing various ethical and sustainable factors. ESG can mean different things to different people. With a huge variety of ESG methodologies and no universal ratings system, it’s like investment company marketing departments have hit the greenwashing jackpot: stick “ESG” on the label and product will fly off the shelves. No wonder, greenwashing is a thing.

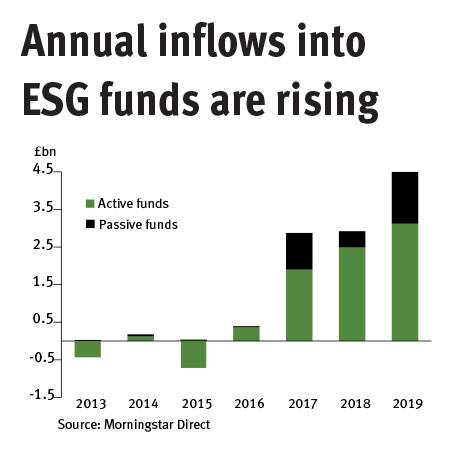

Figure: UK Inflows to ESG Funds

Figure: Remember - ‘90% fat free’ really means 10% fat.

Conclusion

It's still too difficult for an ordinary retail investor to get good access to, and advice on, investing sustainably. Creating an international and broadly diversified portfolio - entirely from retail ethical and sustainable funds – can be difficult and time-consuming, especially if we want to dig down and verify the sustainable credentials of each investment.There are so many ill-defined and fuzzy terms - Sustainable Investing, Socially Responsible Investing (SRI), Environmental, Social and Governance Investing (ESG), Impact Investing, Values-based Investing, Socially-conscious Investing, Green Investing, Climate Bonds, ... – that for an ordinary investor it’s virtually impossible to be sure that his or her portfolio truly reflects personal values.

Greenwashing masks a real - but unmeasured - adoption gap for would-be sustainable investors. Without research it’s difficult to know the figures, but this ‘hidden’ adoption gap may well be as significant as some of the others discussed in this article.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"