12/10/2019. Is Now A Good Time To Invest?

Of all the questions ever asked of a financial advisor, this is by far and away the most common. But what advice is the questioner really seeking? It’s helpful to realise they are asking two separate things:

- “Is now a good time for ME to invest?” and

- “How are the economy and financial markets looking?”

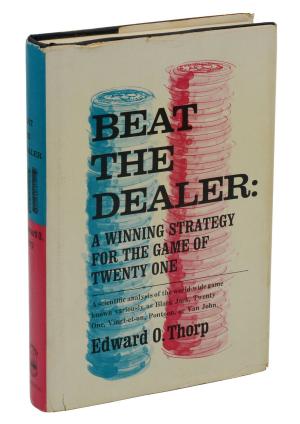

I discovered it as a teenager: “Beat the Dealer” by Edward O. Thorp. Thorp was an MIT mathematics professor who in the dawn era of computing used an IBM 704 to calculate the probability of winning and losing every possible hand in the casino game of Blackjack (also called 21).

By knowing these probabilities, he created a ‘basic strategy’ for playing Blackjack, that can put the odds of beating the house marginally in your favour over the long term. The basic strategy specifies how you should play in every situation. I learned it for fun, and still remember some of the rules, such as “always split aces and eights”.

Once a player has mastered basic strategy, he can learn variants of it, depending on whether the deck is in his favour or not. Edward O. Thorp, sometimes called the father of card counting, describes this in his book. Since then, the whole field of card counting exploded with many different techniques, has featured in numerous movies, and has changed the way casinos operate.

Many people don’t know that card counters don’t actually memorise individual cards as they are played. They are keeping a score in their head that either swings positive or negative, depending on what cards get played and are thus removed from the deck at that point.

In very simple terms, a Blackjack player wants to play a deck that is ‘tens rich’. A tens rich deck has a disproportionately high ratio of ten-scoring cards (i.e. tens and court cards), because more of the low and mid-scoring cards have already been played. In terms of probabilities, a Blackjack player is much more likely to win his hand in this situation.

Knowing whether the deck is in your favour helps not just with varying the basic strategy, but allows you to make decisions on your bet size. A good player, realising that the deck is tens rich, will play hands accordingly, and will also increase bet size to maximise financial advantage from the higher probability of winning. He will similarly reduce his bet size when the deck is against him.

In summary, a good Blackjack player will have (i) an idea of whether the deck is in his/her favour at any point in time, and (ii) a strategy for managing his stake, his bet, in line with this. And this is a wonderful analogue for investing. You must be in the game to win anything at all; what counts is managing your stake.

As investors, conceptually our ‘stake’ is defined by the split between the safer bonds/fixed income part of our portfolio, and equities. This is why your financial advisor takes time to understand your investor risk profile.

So, Is Now A Good Time For ME To Invest?

If you are thinking about the answer to the question, “Is now a good time for ME to invest”, the answer is almost certainly yes, with the caveats that (i) money you definitely need back within two to three years is probably best left as cash, and (ii) your stake size – the proportion of your investment in equities – should reflect your investor risk profile, so that you sleep peacefully at night.Moving on to the second question, “How are the economy and financial markets looking?”. This question is not important at all, if you are a long-term investor. If you are a medium-term investor, then maybe you have a view on markets (but always remember the first Law of Economists). If at any time you feel cautious because too many ten-scoring cards have been played from the deck, then simply adjust your stake size - shift the equities-to-bonds ratio down to your sleeping point.

By the way, Edward O. Thorp is in his eighties, and has had a stellar career not just in mathematics, but as a hedge fund manager.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"