If you hold most of your money in cash, then your chance of losing money is low but so will be any returns. If you invested most of your money in equities, the chance of losing money in the short term is higher, but in the long term the chances of a greater return are also higher.

By maintaining a portfolio in line with your target asset allocation, you can keep an efficient balance of risk and potential returns.

Risk Rating of Investments

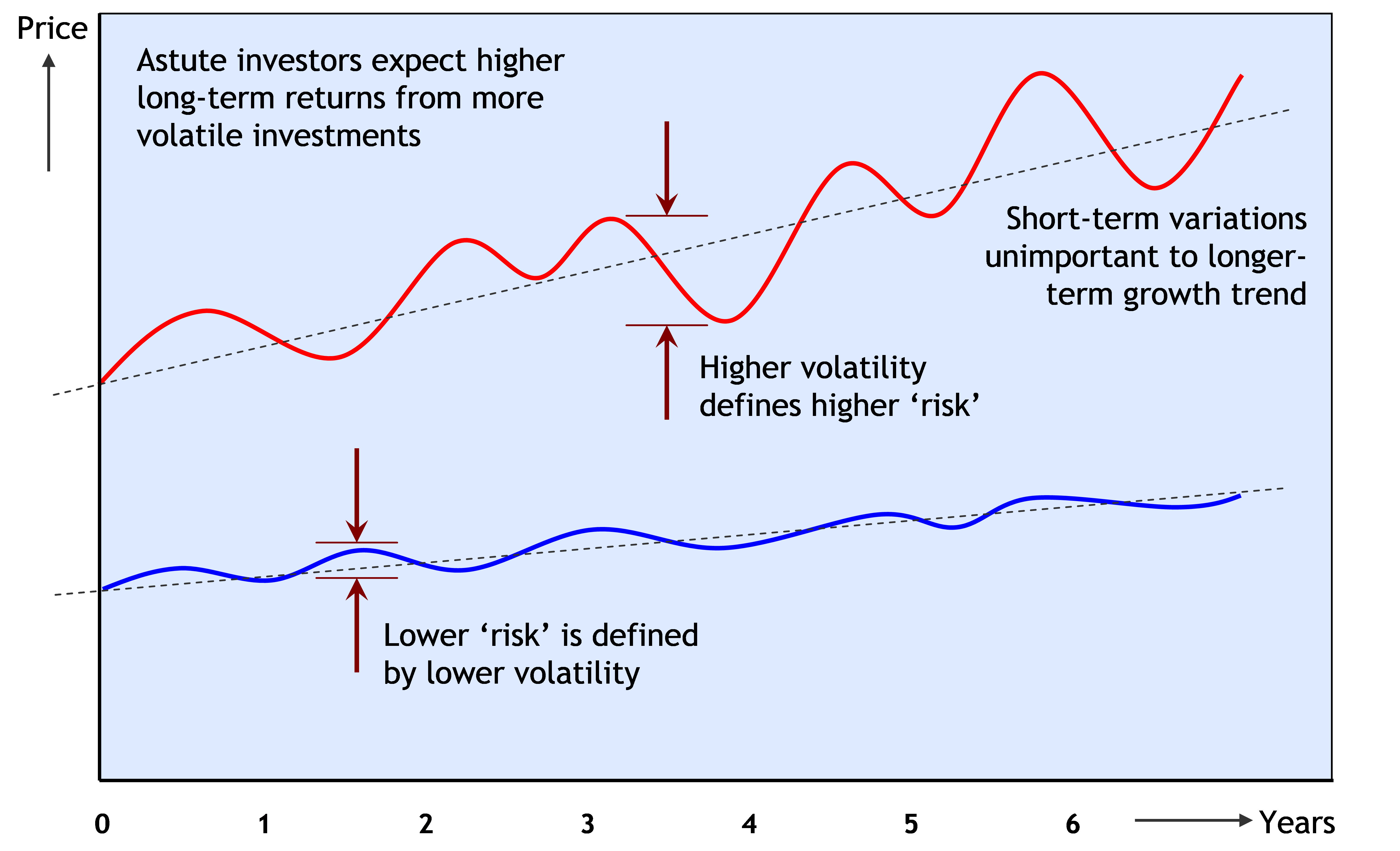

Analysis of stock-markets shows that in the medium to long term the effects of short-term volatility are insignificant when compared to the choice of investment and asset class.A defensive investor with a medium to long term investment horizon may be disappointed with eventual returns if his or her portfolio is overly conservative.

Similarly, during the last few years of a long-term plan, it is important to gradually shift the asset allocation away from more volatile equity funds into less risky asset classes, to ensure that cash values are available as planned on a target maturity date.

Factors Affecting Your Investor Risk Profile

Regardless of the numerous questionnaires that the financial industry likes us to complete, there is no straightforward and easy way to determine the best risk profile. The following factors will have an impact on yours:

1. Your appetite for risk

- your natural tolerance or aversion to a degree of investment risk

- note that this is partly in-built, but also learned, because research shows that previous losses tend to make people more cautious in the future

2. Your ability for risk

- the size of an investment in relation to your overall holdings and income

- the degree to which you can absorb a financial shock

3. Your time horizon

- all else being equal, a shorter time horizon general implies a more defensive investment risk

- a longer time horizon makes it more likely that long term growth trends will outweigh shorter term market fluctuations

4. Investment methodology

- disciplined monthly savings benefit from dollar cost averaging, meaning that a more adventurous investment portfolio might be selected than in the case of a one-off lump sum

5. Your investment experience

- investors with experience of previous market downturns may be better emotionally equipped to ride out future turbulence

- individuals with more knowledge of investment instruments can better assess specific risks in their chosen investments

At the fundamental level, the ‘risk’ of your portfolio is determined by the split between relatively volatile investments (such as equity), and relatively stable investments (such as bonds and fixed income).

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"