Dollar Cost Averaging is a strategy in which an investor places a fixed dollar amount (or indeed any other currency) into a given investment such as a unit trust, on a regular basis. The investment generally takes place each and every month regardless of what is occurring in the financial markets.

As a result, when the price of a given investment rises, the investor will be able to purchase fewer units. When the price declines, the investor will be able to purchase more units.

Millions of investors around the world employ a dollar cost averaging strategy because it offers the following benefits:

- It’s an attractive option for investors who want to contribute to their investment portfolios on a regular basis.

- It eliminates the issue of ‘market timing.’ As a result, an investor’s returns will be determined more by the overall trend in a given fund as opposed to the investor’s specific entry price. In addition, it helps investors reduce their cost basis on securities that decline in value.

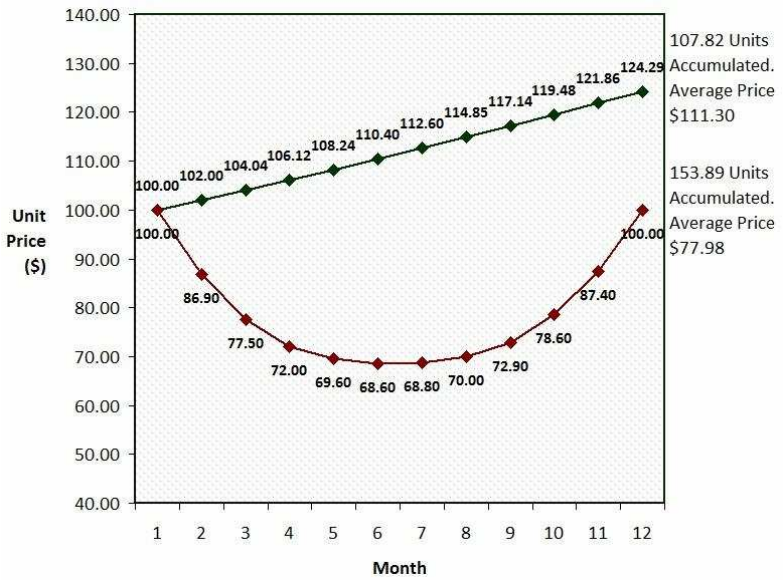

Question: In which fund will you have accumulated your greatest investment value?The answer might be surprising. Take a look at the figures:

In summary, over 12 months, Fund B has delivered better than twice the returns of Fund A in percentage terms!

Real World Example of Dollar Cost Averaging

Let's look at a real world example - the FTSE100 index at the time of the global financial crisis.As you can see from the figure below, if you had bought a FTSE100 tracker in June 2008, you would have had a pretty rough time over the coming few years. A huge plunge (from 60 to 38) followed by a slow recovery - only recovering back to the original purchase price after three years.

But instead of a lump sum, suppose you decide to follow a dollar cost averaging strategy - and 'drip feed' your money into the market. Eg. you could invest £200,000 at a rate of £5000 monthly for forty months.

Here's how you would accumulate units of the FTSE100 over that period:

You can see that after forty months, you would have accumulated 3885.893 units. At a unit price of £60.699, that gives a value of £235,869 (from your original £200,000).

2. Dollar Cost Averaging reduces market timing risks for volatile investments and is a reason why regular savings plans are so popular for building long term financial security. The example above could be twelve years rather than twelve months, but the concept and outcome holds true.

3. Dollar Cost Averaging can be appropriate when considering higher-risk investments such as emerging market funds, if the investor anticipates a positive overall trend in the medium to long term.

Here's how you would accumulate units of the FTSE100 over that period:

You can see that after forty months, you would have accumulated 3885.893 units. At a unit price of £60.699, that gives a value of £235,869 (from your original £200,000).

In other words, during the worst financial crisis of modern times, Dollar Cost Averaging would have created a return of 17.9% on your investment!

Notes about Dollar Cost Averaging:

1. The Dollar Cost Averaging strategy for reducing market risk relies on (i) you having a suitable time horizon for your investments, and (ii) your chosen fund recovering from the decline and returning to the upward trend. In the example above, if you needed access to your funds when Fund B is low, you will make a loss on surrender.2. Dollar Cost Averaging reduces market timing risks for volatile investments and is a reason why regular savings plans are so popular for building long term financial security. The example above could be twelve years rather than twelve months, but the concept and outcome holds true.

3. Dollar Cost Averaging can be appropriate when considering higher-risk investments such as emerging market funds, if the investor anticipates a positive overall trend in the medium to long term.

No comments:

Post a Comment

Roy says: "Thanks for taking the time to leave a message, comment, or continue the conversation!"